This article first appeared on the BNEF mobile app and the Bloomberg Terminal.

- Ethylene margins stay negative for three consecutive months

- Asia producers hit by high feedstock cost and weak demand

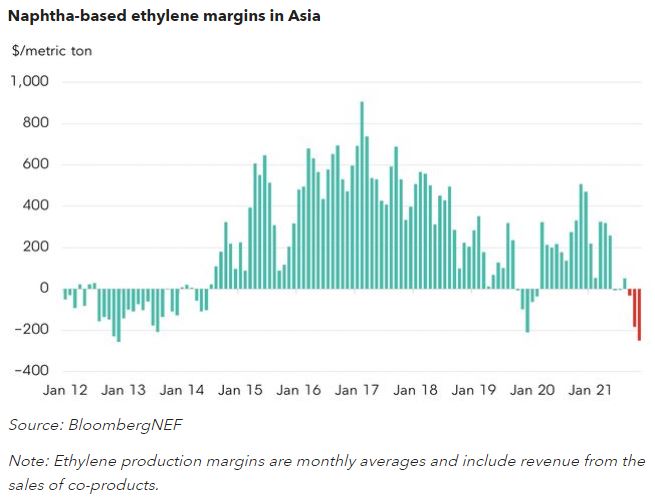

Asian petrochemical producers have been hit hard by prolonged poor margins. Ethylene margins, the benchmark indicator for profitability in the sector, have been negative for three consecutive months. Making one metric ton of ethylene recorded a loss of $250/ton in November, the deepest since 2013.

Squeezing the margins is a combined impact of high feedstock costs and weak demand. Naphtha feedstock prices have surged, much in line with crude oil, by nearly 60% since the beginning of 2021, while ethylene prices increased by just 11% over the same period. The slowdown in plastics demand is the main reason petrochemical makers cannot pass their cost down the value chain.

A bearish outlook for margins adds downward pressures on major producers in the region, including Shell, ExxonMobil and LG Chem. BloombergNEF expects low profitability to force some producers to cut run rates to balance the market.

BNEF Shorts are research excerpts available only on the BNEF mobile app and the Bloomberg Terminal, highlighting key findings from our reports. If you would like to learn more about our services, please contact us.