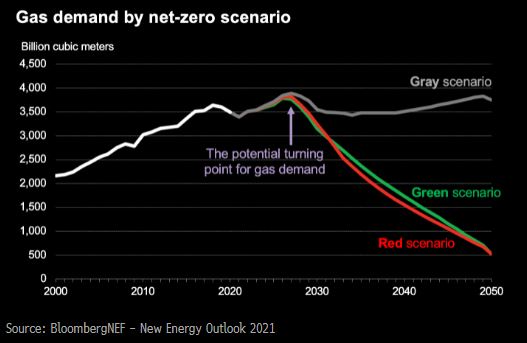

Global natural gas demand is expected to face a turning point in 2030, according to BloombergNEF’s New Energy Outlook 2021, which lays out three different pathways for the world to reach net-zero greenhouse gas emissions by 2050. With the future of liquefied natural gas (LNG) supply projects shrouded in uncertainty, these assets must be prepared for the energy transition in order to remain relevant in a lower-carbon world.

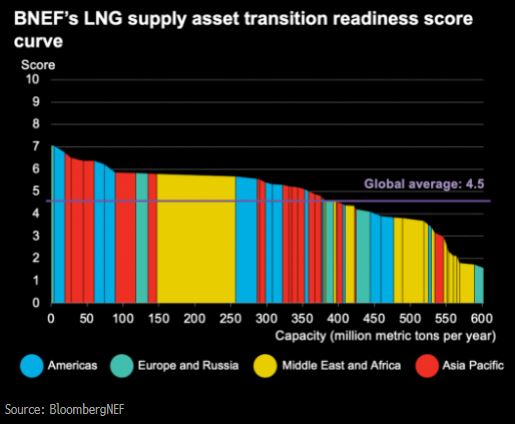

BNEF has scored 49 LNG export plants that are currently operational or under construction on their readiness for the transition, looking at 20 different metrics across their infrastructure and business models. These include the use of carbon capture and storage (CCS) technology, and exposure to stakeholder pressure from net-zero emissions pledges.

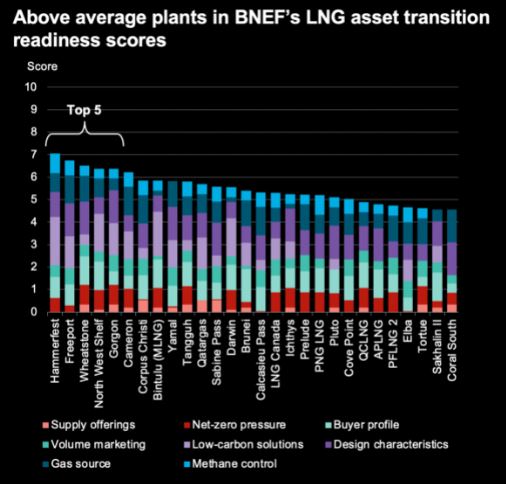

The global average score for these assets is 4.5 out of 10, with Equinor’s Hammerfest LNG plant in Norway and Freeport LNG in the U.S. leading the ranking, and Chevron and Woodside’s Australian plants rounding out the top five. Two-thirds of the annual LNG production capacity assessed, equivalent to 397 million metric tons a year, sits above the global average score. However, there is still room for improvement, as many plants have a long way to go to showing an intent and preparedness for the energy transition.

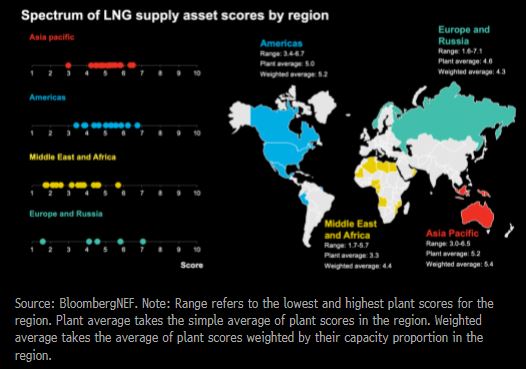

Asia Pacific leads the way, as plants in Africa lag behind

Plants in Asia Pacific and the Americas currently have the highest degree of transition readiness, accounting for 63% of assets with an above-average score. Newer and more efficient plants in the U.S. and Australia show greater intent to decarbonize, leading the adoption of low-carbon technologies, such as a clean power supply and CCS. This is supported by a stronger net-zero alignment across stakeholders in the value chain, from equity investors in the plant through to buyers.

Over half of the laggards with below average scores are in the Middle East and Africa, amid very limited adoption of low-carbon solutions. With no pressure to decarbonize operations in some of these countries, the LNG assets show little intent of becoming transition ready. Most of the host countries are not signatories of the Global Methane Pledge, and the priority for some of these newer gas producers may be on monetizing their resources rather than the transition.

Plants that sit lower on the transition-readiness curve are going to be hard-pressed when it comes to future contract renewals, as they will have to compete with younger and more carbon-conscious LNG plants. Facilities that run a higher risk of emissions aren’t aligned with the transition and would benefit from stakeholder pressure to decarbonize in line with net-zero goals.