By Bryony Collins, Bloomberg New Energy Finance editorial team. This article first appeared on the Bloomberg Terminal and is available to BNEF clients on the web.

Battery storage company Sonnen offers customers in Germany the opportunity to own their own electricity supply. It says solar panels and a Sonnen battery can supply around 75 percent of a typical household’s electricity use, with the remainder supplied from the grid for free in return for balancing services provided.

A quarter of the 15,000 battery systems installed in Germany by Bavaria-based Sonnen are currently providing frequency regulation services to the grid. The resulting extra income means that customers can access grid power for free when their solar panels don’t supply enough electricity.

Sonnen’s offer of free grid power “significantly improves the business case for the customer” to purchase battery storage, Chief Executive Christoph Ostermann told BNEF in an interview. It reduces the payback period to cover the cost of the system by between 2 and 4 years. Currently, payback is 11-12 years in Germany, according to the company.

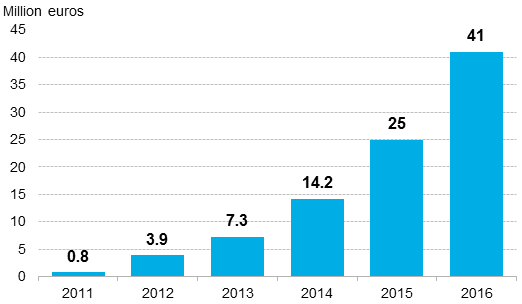

Sonnen’s revenues increased on average by 120% each year over the past 5 years

Source: Sonnen

BNEF spoke with Christoph Ostermann in the following interview.

Q: Give us some background to Sonnen?

A: We were the first company to supply lithium-ion based residential energy storage and today we are the world market leader, according to a Frost and Sullivan survey.

We are headquartered in Bavaria, Germany and ship from there to European countries. We also have a subsidiary in Georgia, U.S.

For the first time last year we generated a significant share of our global revenues abroad – with a share of 35 percent, and in 2017 we expect to make 45-50 percent share from countries outside Germany.

Q: What is the Sonnen Community?

A: We currently have just over 20,000 [battery storage] systems deployed [globally] and they are all online, so we get a lot of data about energy generation and consumption. In 2014, we compared this data and found that the accumulated customer base is generating more in solar power than it needs. So we had the idea to virtual-connect all our customers in Germany via a platform we call the Sonnen Community, and over this platform our customers can share excess solar power.

Technically-speaking, this means that we are buying excess solar power from customers and selling it peer-to-peer to other customers for a price 25 percent below the German market price.

This has been in place since 2015, and in late 2016 we started also providing frequency regulation to grid operators in Germany, which allows us to generate additional income from the storage systems of our customers. To share this economic benefit with our customers, we supply them with grid power for free. Since this service has been introduced, most customers choose this option when they need more electricity rather than buying power from other members of the community.

This is extremely exciting because we are replacing 100 percent of our customers’ power supply and replacing the utility. By being able to offer this grid power for free, it significantly improves the business case for the customer. The payback [period for your system] depends on geography. In Australia you have 8 years payback for the solar and battery storage combined, in Germany 11-12 years, and in the U.S. it’s around 10 years. By getting grid power for free, this payback period drops down by another 2 to 4 years.

Q: This frequency regulation service is only available in Germany at the moment?

A: At the moment it’s available to all our German customers, [but there is a pool of 4,000 customers currently enrolled]. This concept, called Sonnen Community, is also being piloted in Italy, Australia and shortly Prescott, Arizona.

All utilities are facing the same problem of high volatility of renewable power generation and they are all looking for flexibility to better manage their grid. This is why the flexibility we can offer them with a virtual power plant of thousands of residential solar systems is so relevant to them.

Q: How much frequency regulation can you offer the grid?

A: We have 15,000 systems deployed in Germany, half of which were installed in the last two years. The market in Germany is growing by 500-700 units each month. These 15,000 systems have an average power of 3.5 kilowatts, so overall we can manage 50 megawatts of power. And there are 100 megawatt-hours of storage capacity in the accumulated base that we can manage. It’s still a relatively small number compared to a gas-fired power plant, but deployment is increasing very fast.

Q: Are you open to partnerships or acquisition by utilities, or would you like to maintain your own identity?

A: We are open to that and we have relationships with most large German utilities. Once we started offering grid power to our customers, they were a bit hesitant about continuing the relationship with us. However, we are still cooperating with EON in Sweden and we are very open to further cooperation. The energy industry is transforming and needs new business models, so if we can deploy that together then it’s good for everybody.

Q: What are your plans for Sonnen’s future – do you intend to stay private or go public?

A: At the moment, we are in the fortunate situation that it’s relatively easy for us to get financing via the private equity market. We think that we are still a bit too small and we want to concentrate on delivering a couple of proof points before we make the step to go public. This year, we will not have reached $100 million for example and we are not expecting to be profitable, so an IPO is something we consider really in 2-3 years.

Q: What was your revenue in 2016, and expected for 2017?

A: In 2016 it was 41 million euros, and this year it will be a bit below 60 million euros.