BloombergNEF’s Executive Factbook is our look at the most important developments in decarbonization, digital transformation, and the energy transition. The aim of this Factbook is to highlight the many strategic solutions for decarbonization at scale in a global, interconnected context. We published our first Factbook in 2020, in part as a long-term response to the near-term uncertainties of the Covid-19 pandemic; response was so positive that we are now publishing annually.

2020 was an unusual world for the global economy, to say the least. Many of you reading this note spent it at home, sheltering from an ongoing pandemic. The systems underpinning that global economy responded in relatively expected ways, with slowdowns and shutdowns, and in some unexpected ways, such as a significant shift to remote working and remotely delivered services previously not thought possible at such scale or volume.

The systems of our global economy – power, transport, industry buildings and digital, food and agriculture, and capital markets – are also part of the earth system. Human interaction with the earth system has never been more clear. 2020 was the second-warmest year on record, with atmospheric carbon dioxide levels not seen in 800,000 years. A pandemic may have dented annual emissions; it has not arrested their long-term trend.

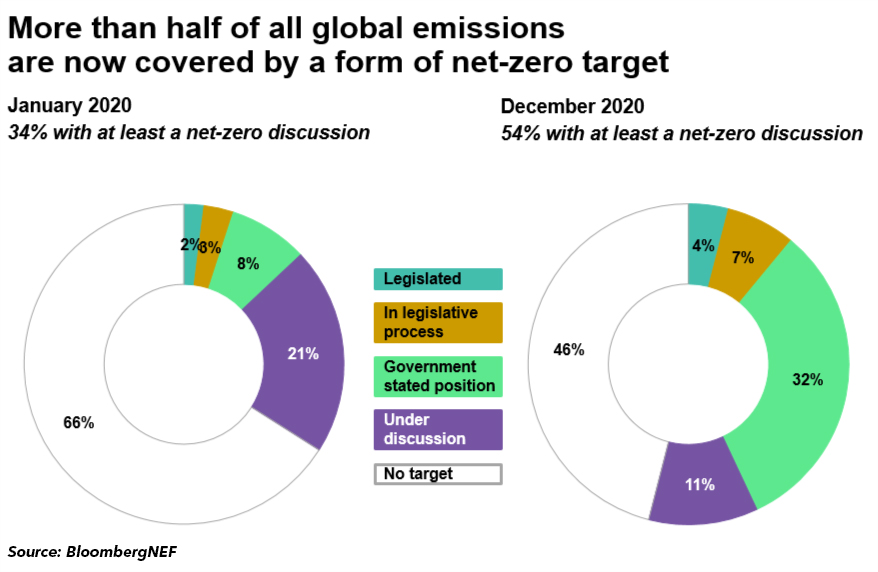

At the same time, though, the ways in which many sector trends defied the pandemic allow us to consider how we might embark on much greater decarbonization. At the beginning of 2020, 34% of global emissions were covered by a net-zero target; by the end of the year, 54% were covered – an exceptional additional commitment despite the pandemic. BloombergNEF’s 2020 New Energy Outlook finds that global primary energy demand peaked in 2019, though it will recover after dropping last year; meanwhile, emissions from both the global power sector and from coal combustion peaked in 2018. Investment in the energy transition reached an all-time high, of $501 billion; sustainable debt an all-time high issuance, of $732 billion; clean energy capital markets were at all-time highs, as were share issuances.

Wind and solar power are now the least-expensive option for bulk electricity for two-thirds of the global population, 71% of global GDP, and 85% of global power generation. Electric vehicle sales thoroughly defied the auto industry’s overall dismal year, with sales rising 40% from 2019. Finally, infrastructure itself was resilient. The global Internet has allowed us to work from home, and remotely, at a previously unimagined scale, and the clean electricity infrastructure that increasingly powers the cloud was equally resilient.

The Factbook is available for download here.