This article first appeared on the BNEF mobile app and the Bloomberg Terminal.

- Thirteen funds have closed $2.8 billion since December 2021

- Circular economy funds surpassed targets with $383 million

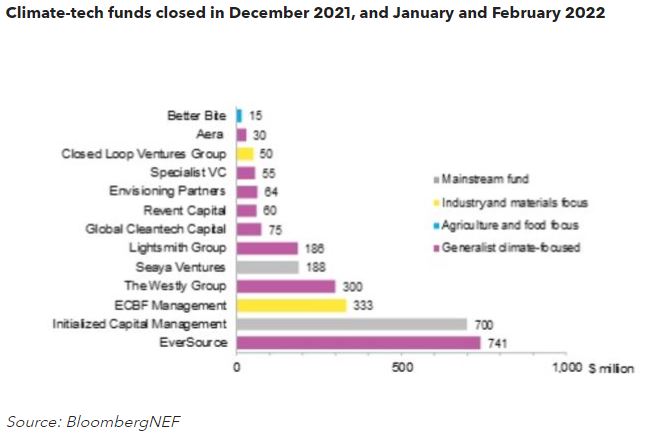

Thirteen climate-focused venture capital and private equity funds closed in the past three months, raising $2.8 billion of fresh capital. This includes over $1 billion secured by Westly Group and EverSource, whose climate-generalist funds mention decarbonizing energy, transport and industry as focus areas. The total also encompasses two mainstream funds from Initialized Capital and Seaya Ventures, as they reference these sectors as a focus too.

Amid the growing appeal of investing in climate tech, two firms exceeded their fundraising targets — Closed Loop Partners and ECBP Management attracted $50 million and $333 million, respectively, for their circular economy funds. Both funds’ limited partners include Nestle and Microsoft, highlighting how large corporations are increasingly interested in shifting to sustainable materials and renovating supply chains.

BloombergNEF tracked $29 billion raised by new climate-tech focused funds in the second half of 2021. Recent evidence suggests 2022 will be another strong year for fundraising.

For more detail on these findings, an abridged version of the 2022 Energy Transition Investment Trends Report can be downloaded from this page. BNEF subscribers can find the full report on the client website and on the Bloomberg Terminal.