- Companies scurry to position for transition upside, avoid downside

- BNEF tools analyze transition risk for 4000+ public equities

Climate transition risks today already influence a variety of corporate decisions from restructurings to partnerships. As the shift to net-zero accelerates, it will continue to drive new strategies and investment plans. For corporations and their investors, now is a crucial time to grapple with relevant transition risks so that they may plan the best climate adaptation path going forward.

Companies essentially have two paths ahead of them. One, is to continue business as usual and risk losing market share as the net-zero transition shifts the dynamics of the global economy. The alternative is to invest in adaptive action now and slowly shift the business model in order to participate in future net-zero-related upside (while avoiding downside). BNEF’s ongoing transition risk data and research help clients explore these two paths for a large universe of companies.

Revenue-at-Risk

A profitable business model in today’s fossil-fuel-dependent economy is not guaranteed to be successful in a clean-energy, net-zero world. Of course the transition will bring upside for some existing business segments, but the question most investors are asking is “how much revenue downside does any particular firm face”?

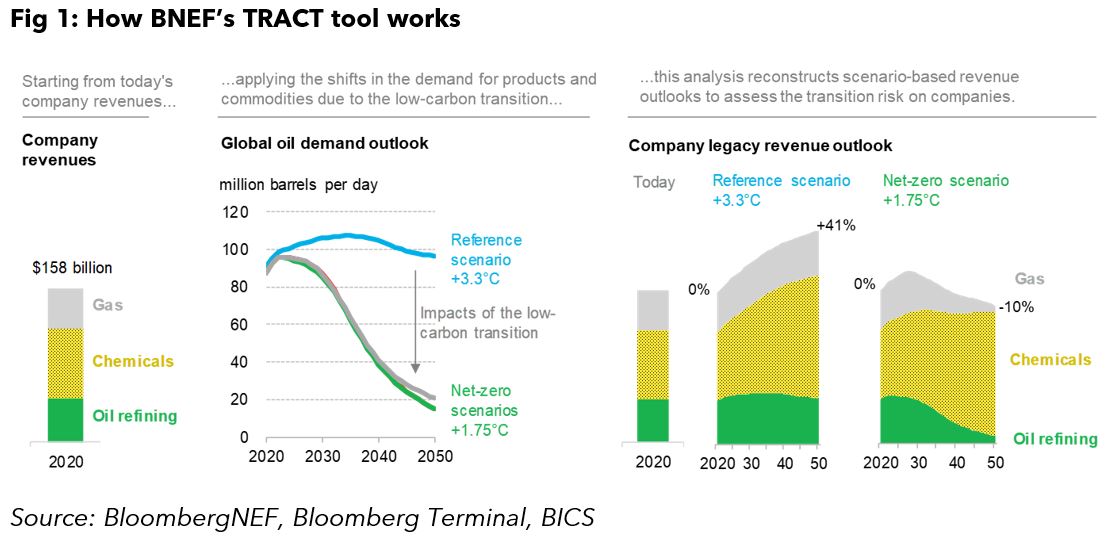

BNEF’s Transition Risk Assessment Company Tool (TRACT) model projects how future revenues will shift assuming no change in current business model. The model covers over 4000 public equities globally, providing upside and downside revenue exposure for each. Calculations link data from each company’s reported revenue with BNEF’s assessment of key trends within the energy transition such as global oil and power demand.

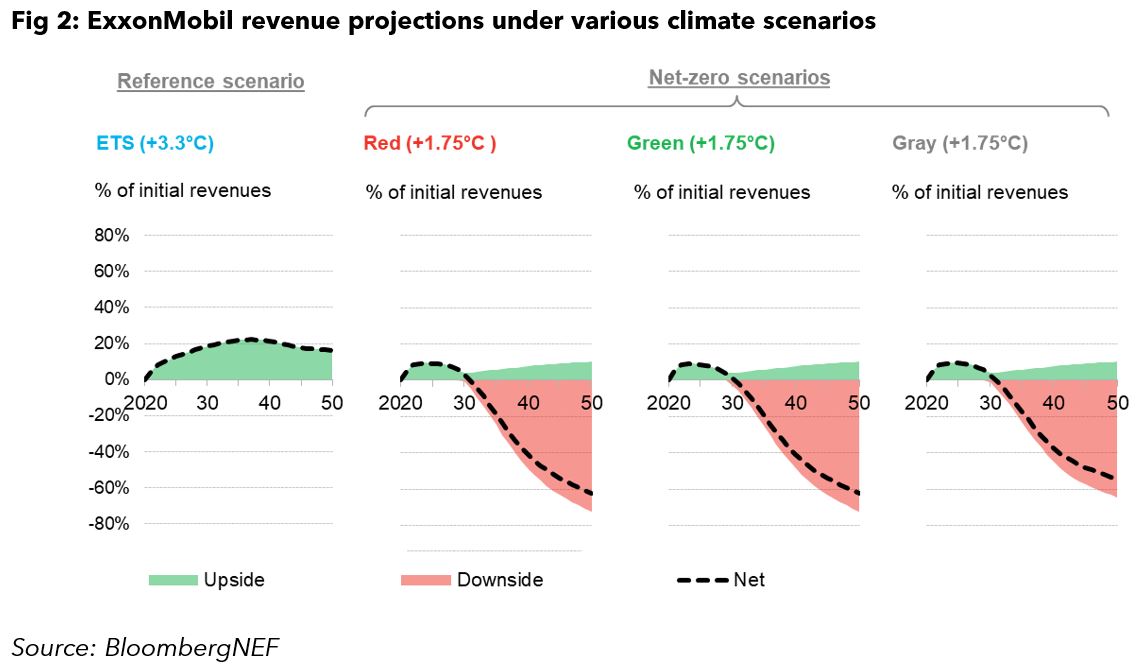

Oil & gas companies that maintain business as usual are at risk of losing substantial revenues. In the above example, if Total makes no further change to its business model (ie revenue segments and contribution proportions remain unchanged), its 2050 revenue under a net-zero scenario is projected to be 10% lower than its revenues from 2020. Compared to other oil majors, Total faces lower transition risk because of its high exposure to the chemicals sub-sector rather than oil exploration or processing. In contrast, under the same scenarios Exxon Mobil’s 2050 revenue is projected to be roughly 60% lower than its 2020 baseline. These and other projections are explained in depth in the interactive TRACT tool.

Business Model Adaptation

Given mounting net-zero pressure from policymakers, investors and customers, it is highly unlikely that companies can avoid taking adaptive action. One way or another, corporate business models will shift to accommodate low-carbon market trends, particularly in high-emissions sectors like mining, oil and gas, utilities and automotive. Even now in the early stages of this shift, there is a lot to consider when it comes to evaluating company direction and speed of adaptation.

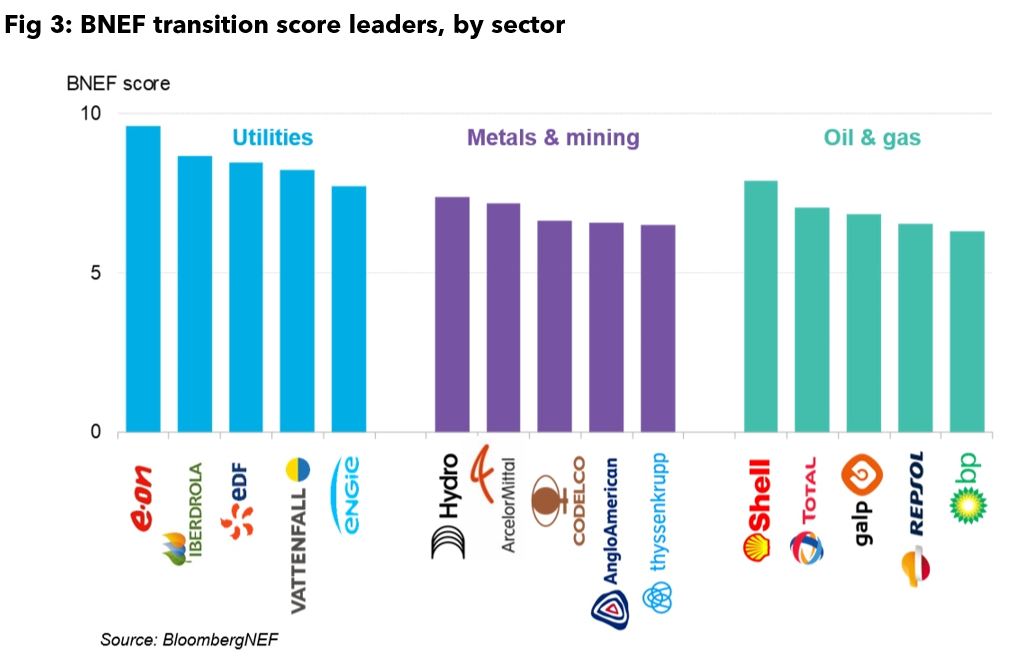

BNEF’s transition scores track how companies are adapting their businesses to the climate transition and which are in the lead. To do so, in-depth analysis covers risks inherent in the current business as well as efforts to align revenue segments with net-zero. To date, scores are available for 190 companies across oil, gas, utilities and mining, with the automotive sector coming soon. Each set of scores is sector-specific and compares companies only to peers in the same industry.

Across sectors, leading companies tend to be based in Europe, where strong climate policy sets the pace for climate adaptation. Policy is a powerful net-zero accelerant because it creates a positive network effect. For instance, clean energy policies targeted towards utilities eventually benefit all downstream companies by naturally helping them reduce electricity-related emissions.

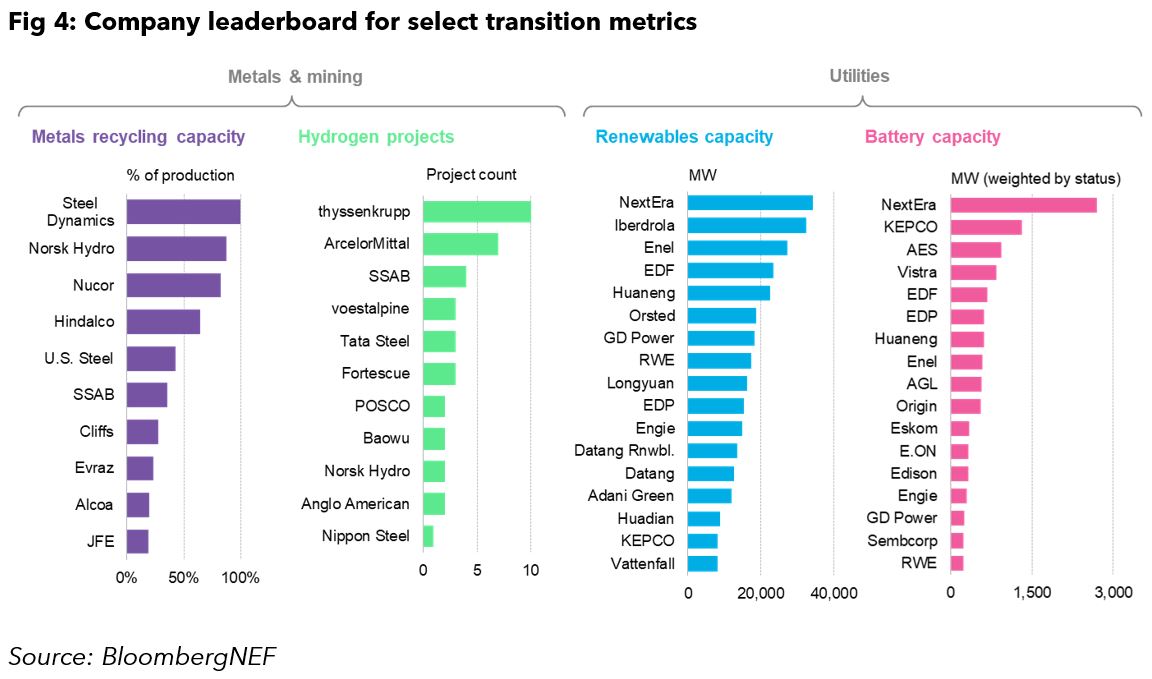

A large part of the scoring model draws upon project-level investments across relevant low-carbon technologies and revenue streams. While the most pertinent technologies differ by sector, BNEF’s various project databases track these investments in a standardized way for all companies. As an example, metals recycling capacity and hydrogen projects are both important for metalmakers, whereas renewables and battery capacity are more relevant to utilities. BNEF’s transition scores take into account sector-by-sector nuances when it comes to climate transition in order to produce a peer comparison of the companies best-positioned for success in a net-zero world.