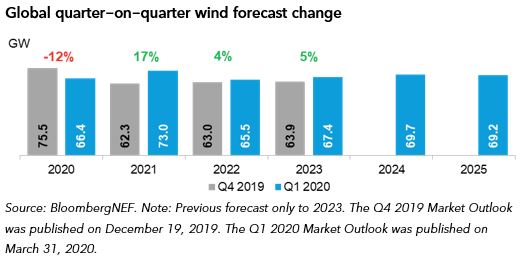

The spread of Covid-19 has plunged the wind industry into unprecedented uncertainty. Supply-chain disruption and labor shortages are putting what promised to be a record year into jeopardy and have caused us to slash our 2020 onshore wind forecast.

Industry-defining news comes almost hourly, challenging forecasts and forcing revisions. We are constantly monitoring the outbreak against our potential scenarios and updating our views accordingly.

So far the impact is greatest in busy markets in Europe and the U.S., where delays put even more strain on tight construction schedules. We predict much of this capacity will roll over into 2021, meaning global installations surpass 70GW for the first time.

In countries hit hardest by the virus, we assume a two- to three-month project execution delay. After this, we assume countries individually return to a more normal situation, as suppression measures are gradually relaxed (though some targeted measures and travel restrictions remain in place).

Our offshore forecast remains unchanged. Unlike in onshore wind, installations were already expected to be low in 2020. Most of this year’s capacity will come online in China, where construction schedules are largely unaffected, while many European projects are already at a late stage of construction. Most developers remain adamant that construction schedules are on track, for now.

Project execution stalls

Informal letters warning of the potential need to trigger force majeure contract clauses are becoming commonplace, passing along the value chain from component suppliers to financiers. The extent to which construction has already been disrupted differs greatly between markets. Work has reportedly stopped on many projects in France, but is ongoing in other locked-down countries like Spain.

Delays to certain construction tasks are causing chain reactions in project timelines, challenging conventional construction logistics. For example, scheduling a turbine foundation concrete pour is impossible amid uncertainty over both the supply of raw materials and labor.

For most developers, project holdups will delay revenue but are manageable. Unfortunately, a timing crisis is developing in some markets, especially the world’s two largest wind markets – China and the U.S., where delayed projects are at risk of missing 2020 subsidy deadlines. There are early signs that officials in some countries may be lenient. Germany’s federal network agency has announced that projects successful in previous auctions will be granted an extension to commissioning deadlines. U.S. developers are lobbying hard to secure an extension to the full production tax credit. In China, there are calls for a three-month extension to the end of year deadline, but the recently published 2020 wind policy did not grant an extension.

The maintenance headache

Companies are facing the difficult task of trying to keep turbines running while looking after their employees. Electricity generators are usually exempt from even the strictest countrywide lockdowns, but health and safety regulations often require technicians to work in pairs or groups on-site, making social distancing impossible.

In Europe, the vast majority of scheduled maintenance happens in summer, when wind speeds are lower. Facing a shortage of turbine technicians, operators are trying to calculate the health of each asset to work out how much longer each can run before risking serious damage. In some cases, disregarding maintenance schedules can void turbine warranty, leaving no choice but to switch off.

Clients can find the full ”1Q 2020 Global Wind Market Outlook” on The Terminal or on web.