The U.S. has a unique opportunity to become the world’s premier source of zero-methane natural gas. Demethanization, or dramatically curbing methane emissions, will allow operators to sell a differentiated product and capture greater global market share. This transformation is critical if the U.S. is to achieve its emissions targets. However, the clock is ticking. Precise aerial data, greater operator transparency and stricter legislation will set in stone the emissions hierarchy of energy exporters over the next ten years.

- Eliminating methane emissions begins at the company level. This involves accurately measuring emissions from all assets before employing reduction practices. The actions of privately owned companies are key: they can use greater operational flexibility to proactively improve transparency and mitigation, or, they can decide to focus on short-term profitability and ignore concerns around methane. Meanwhile, public corporations are on a more settled but very slow path to demethanization. Environmentally focused investors should pressure these companies to accurately measure emissions rather than rely on EPA assumptions.

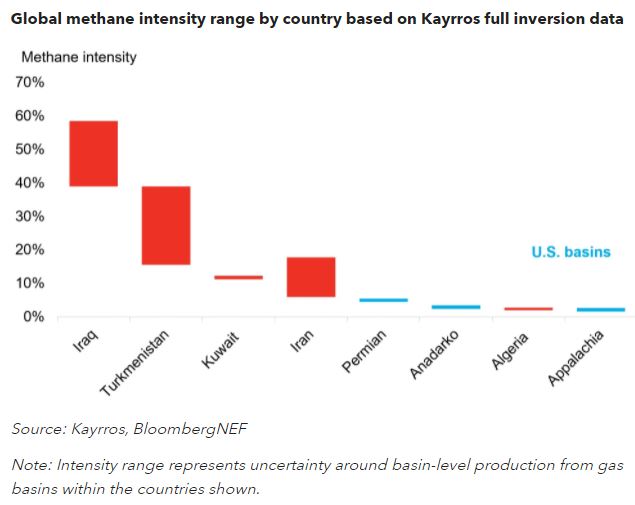

- The U.S. oil and gas industry has a lower methane intensity than its major gas-exporting rivals. The nation is in a strong but delicate position thanks to its greater transparency. Improvements to satellite technology will provide a clearer global emissions picture. The U.S. could be left behind in the next cycle of hydrocarbon demand growth, but appropriate demethanization strategies offer the opportunity to capitalize on current strengths.

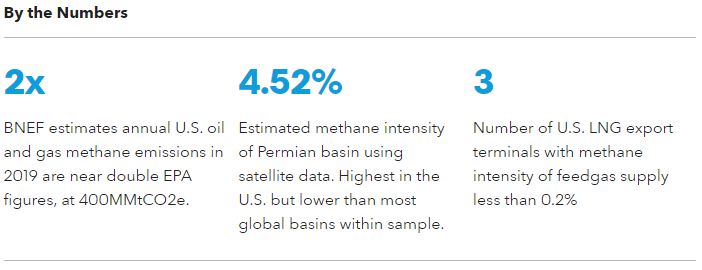

- Demethanization is paramount to achieving the U.S.’ emissions goals. Methane is the second largest source of greenhouse gas emissions in the U.S. behind carbon dioxide; yet, the full extent of its release is unknown. Grossed up estimates from satellite data show total emissions from oil and gas are close to 400MMtCO2e, double the Environmental Protection Agency’s estimates. This would represent 6-7% of the country’s overall emissions footprint.