This article first appeared on the BNEF mobile app and the Bloomberg Terminal.

- Didi has raised $4 billion for R&D, international expansions

- Softbank and Didi have backed most of the global leaders

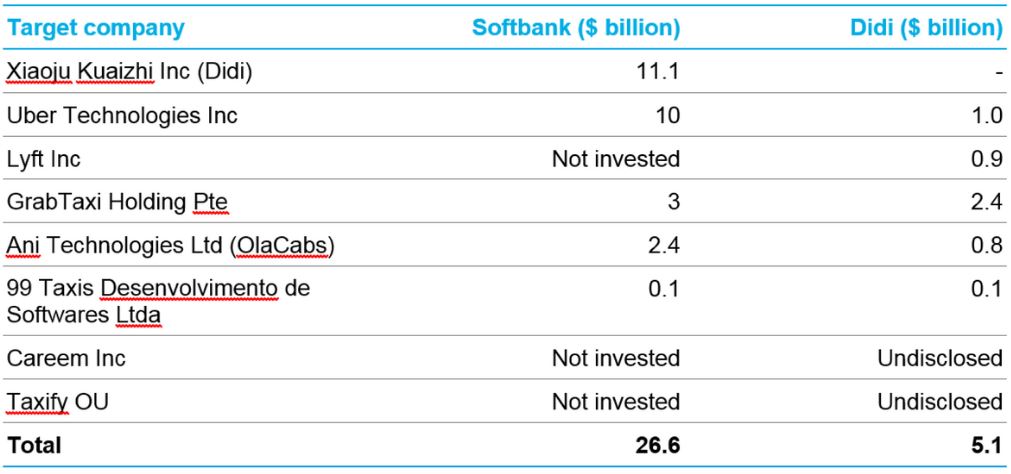

Softbank and Didi’s investments in digital hailing (value of funding round)

Source: Bloomberg New Energy Finance, CB Insights.

Notes: Total value of the investment/acquisition deals does not represent the amount of money invested by the companies. The value of the two funding rounds where Didi and Softbank were involved together was kept unchanged (includes a $2 billion funding round in GrabTaxi on July 24, 2017 and $0.28 billion in OlaCabs November 18, 2015). Softbank’s participation in a $0.6 billion round in Kuaidi Dache in December 31, 2014 included as part of its investment in Didi. Softbank’s $10 billion investment in Uber is not finalized. The $1 billion investment in Uber by Didi is part of the acquisition of Uber China Ltd. in August 1, 2016.

Softbank Group Corp, the leading tech investor in ride hailing, has backed Xiaoju Kuaizhi Inc (Didi) since 2014, participating in over $11 billion of funding rounds for the company – including the latest $4 billion round. Combined, Didi and Softbank have invested in most of the leading ride and car hailing service providers globally, with the notable exception of Get Taxi Inc, which is backed by Volkswagen AG. Didi said it will use part of the new cash to consolidate its presence outside of China, a strategy well underway as evidenced by its portfolio of investments in ride hailing companies around the world.

BNEF clients can see the full report, “Digital Ride Hailing: the Global Landscape”, here.

BNEF Shorts are research excerpts available only on the BNEF mobile app and the Bloomberg Terminal, highlighting key findings from our reports. If you would like to learn more about our service.