Key findings in the report, Electric Buses in Cities: Driving Towards Cleaner Air and Lower CO2, authored by BNEF on behalf of the C40 Cities Climate Leadership Group, highlight e-buses’ competitiveness with conventional diesel and CNG fueled buses.

Air quality is a growing concern in many urban environments and has direct health implications for residents. Tailpipe emissions from internal combustion engines are one of the major sources of harmful pollutants such as nitrogen oxides and particulates. Diesel engines in particular have very high nitrogen oxide emissions and yet these make up the majority of the global bus fleet.

As the world’s urban population continues to grow, identifying sustainable, cost effective transport options is becoming more critical. Electric vehicles – including electric buses – are one of the most promising ways of reducing harmful emissions and improving overall air quality in cities.

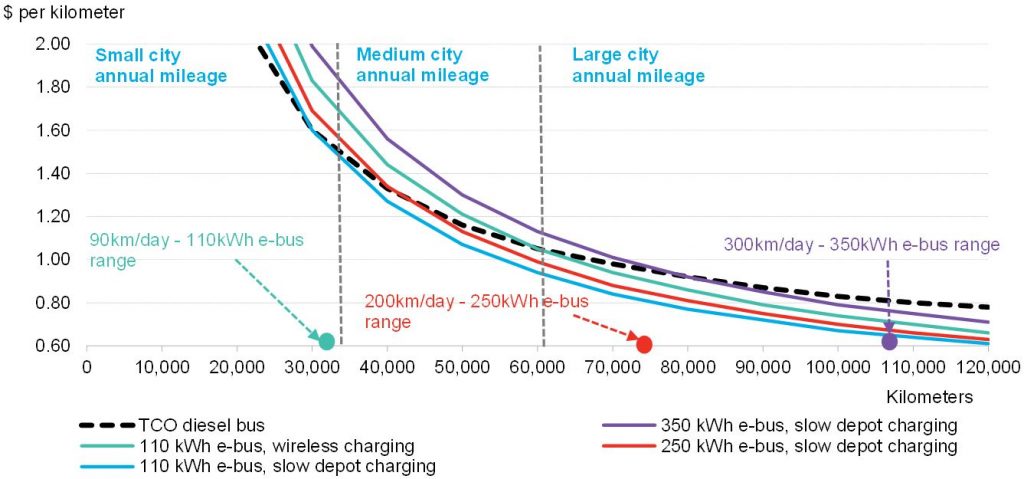

E-buses have much lower operating costs and can already be cheaper, on the basis of total cost of ownership, than conventional buses today. The TCO of all electric bus configurations that we modelled improves significantly in relation to diesel buses as the number of kilometers traveled annually increases. For example, a 110kWh battery e-bus coupled with the most expensive wireless charging reaches TCO parity with diesel bus at around 60,000km traveled per year (37,000 miles).This means that a bus with the smallest battery, even when coupled with the most expensive charging option, would be cheaper to run in a medium sized city, where buses travel on average 170km/day (106 miles).

TCO comparison for e-buses and diesel buses with different annual distance traveled

Source: Bloomberg New Energy Finance. Notes: Diesel price at $0.66/liter ($2.5/gallon), electricity price at $0.10/kWh, annual kilometers traveled – variable. Bus route length will not always correspond with city size.

Large cities with high annual bus mileages can therefore choose from a number of electric options, all cheaper than diesel and CNG buses. Even the most expensive electric bus – the 350kWh battery e-bus, slowly charged once per day at the depot – at 80,000km per year has a TCO of $0.92/km, just at par with diesel buses. Compared to a CNG bus, it is around $0.11/km cheaper in terms of the TCO. This indicates that in a megacity, where buses travel at least 220km/day, using even the most expensive 350kWh e-bus instead of a CNG bus could bring around $130,000 in operational cost savings over the 15-year lifetime of a bus.

Despite the potential operational savings, there are still some challenges for electric buses, with their high upfront cost compared to equivalent diesel buses being one of the biggest obstacles. To tackle this, new business models are emerging, involving battery leasing, joint procurement and bus sharing. However, our analysis of battery cost curves indicates that electric buses will reach unsubsidized upfront cost parity with diesel buses by around 2030. By then, the battery pack in the average e-bus should only account for around 8% of the total e-bus price – down from around 26% in 2016. Furthermore, increasing demand for e-buses could bring e-bus battery prices down faster. In that case, electric buses would reach cost parity with diesel buses by the mid-2020s.

The full report is available for download here.

C40 released this report at the Financing Sustainable Cities Forum in New York City on April 10, 2018. Through their work and programs like the Financing Sustainable Cities Initiative – a partnership funded by the Citi Foundation between C40 and WRI Ross Center for Sustainable Cities – C40 provides technical resources to help cities make the most efficient and most cost-effective policy and procurement decisions for their own circumstances.