A scramble by the lithium market’s biggest players to tie up supply of the high-tech metal is gathering pace in the 170-year-old heartland of Australia’s $90 billion mining industry.

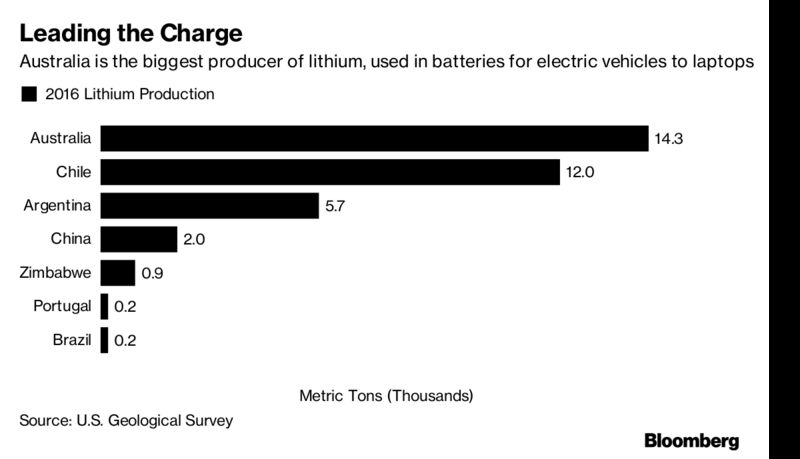

Rising Chinese demand for lithium-ion batteries needed for electric vehicles and energy storage is driving significant price gains and an asset boom in Australia, already the world’s largest lithium producer. The fast-developing hub is drawing investment and deals from global producers as well as chemical-to-battery manufacturers in China, the top consumer.

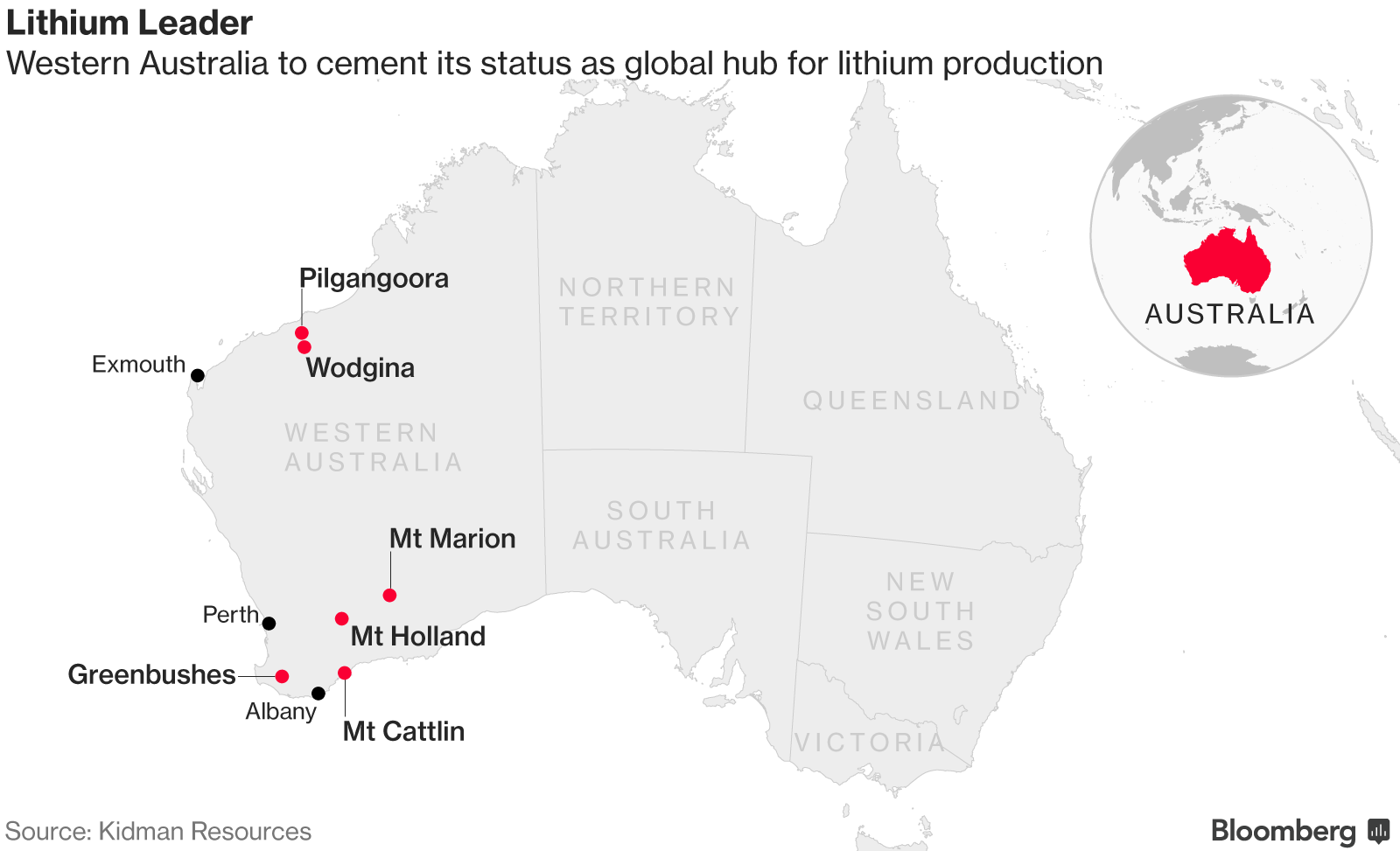

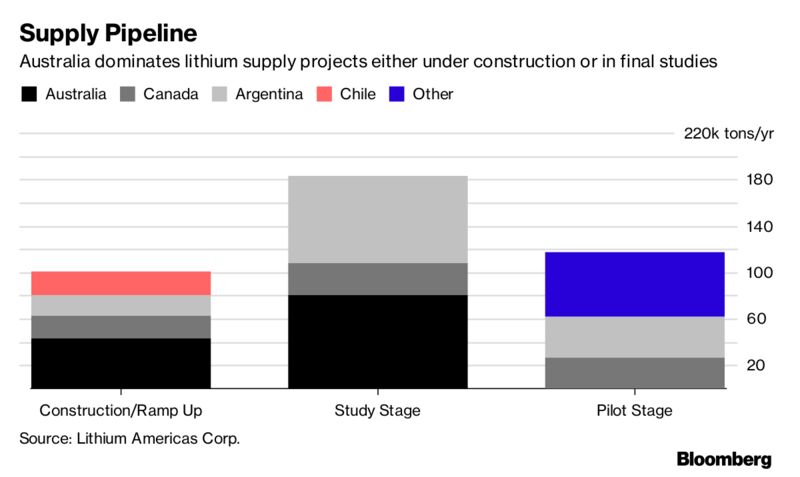

Western Australia has four operations in production and three more major projects being advanced to begin output. Major players are likely to continue to scope for deals in the state to secure supply for the next 20 or 30 years, according to consultant Benchmark Mineral Intelligence.

“There are serious companies investing and people are starting to lock up the biggest, long-life resources. The question is — who’s next?” Simon Moores, managing director of Benchmark Mineral said by phone from London. Though on a smaller scale, “it’s a land grab like in the petroleum industry when BP, Shell and others rounded on the Middle East in the 1960s and 1970s,” he said.

Greenbushes in Western Australia, the world’s biggest hard-rock lithium mine, is being expanded to more than double annual capacity, Talison Lithium, a joint venture between China’s Tianqi Lithium Corp. and North Carolina’s Albemarle Corp., said in an email. The site, first mined for tin from about 1888, already accounts for about 30 percent of global lithium production, according to Australia’s government. Tianqi is also planning about A$717 million ($578 million) of processing plant expansions.Jiangxi Ganfeng Lithium Co., which has interests in projects in countries including Ireland and Argentina, holds about 43 percent of Australia’s Mt. Marion operation and in May agreed a supply and investment pact with Pilbara Minerals Ltd. for a mine development. Battery maker Shaanxi J&R Optimum Energy Co. in July struck an agreement for future output from Altura Mining Ltd.’s project.

An open pit mine at the lithium operation site of Talison Lithium Ltd. in Greenbushes.

Suppliers of lithium products are likely to be joined in the chase to secure Australian materials by end-users, including car manufacturers, Pilbara CEO Ken Brinsden told reporters Monday on the forum’s sidelines. “The next catalyst for the industry as a whole is when the big battery makers and even auto-makers start to look to get a position in lithium raw materials,” he said. “It’s starting to dawn on them that there could be a supply chain issue.”

Perth-based Mineral Resources is a touchstone for the shift from old-to-new industry in Western Australia as this fiscal year the iron ore producer will earn more from lithium than the steel-making ingredient, according to Deutsche Bank AG, which has a buy rating on the stock. It also sees Albemarle and Orocobre Ltd. as among the best global lithium prospects.

Lithium’s current $2.5 billion market is a fraction of the $86 billion a year seaborne iron ore trade and some miners have eschewed opportunities to add projects. Fortescue Metals Group Ltd. in December agreed the sale of a lithium exploration portfolio. BHP Billiton Ltd. argues it’s poised to benefit most from electric vehicle growth through copper demand. Australia will face competition from lithium projects in Canada, Chile and Argentina, according to UBS.

New lithium production and a potential addition of cobalt output and graphite projects — two other metals experiencing rapid demand growth from the battery sector — promise to add to mining exports from Australia. The value of mined exports is forecast at A$113.7 billion ($89.6 billion) in the year to next June 30, according to its government.