Countries are on the hook more than ever to tackle runaway greenhouse gas emissions and to encourage private sector actors to do the same. Underpinning these emission reductions is the policy suite each nation offers to implement its agenda, with a large portion of these policies specifically focused on measuring and communicating the climate impact from companies and the financial sector. Falling into two main groups, sustainable finance and environmental, social and governance (ESG) disclosure, these policies can take different forms, such as a national sustainable finance strategy or a taxonomy defining which activities or investments qualify as green or sustainable.

BloombergNEF has recently published a report entitled Unpacking the Baggage of ESG Regulation (clients can access the full report here: web | terminal) analyzing the global regulatory landscape for ESG disclosure and sustainable finance policy. As of August 2021, 86 markets have welcomed such regulations and guidelines, whether mandatory or voluntary, from government bodies, industry groups and international organizations. But not all markets perform similarly – while European countries have taken a leadership role in establishing sustainable finance and ESG disclosure policy, other major economies lag behind.

Europe stands above the rest

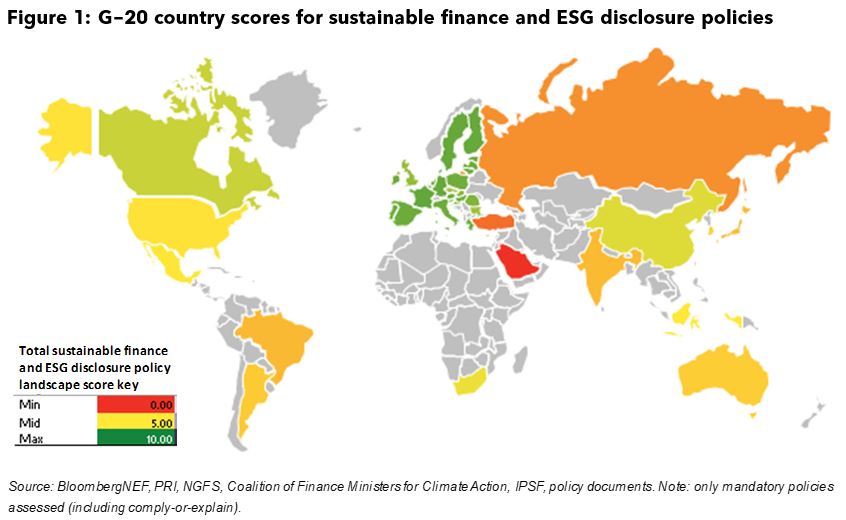

As part of this analysis, BloombergNEF assessed G-20 countries’ mandatory sustainable finance and ESG disclosure policies, scoring countries’ regulatory landscapes from zero to ten. Countries are assessed on the scope of their policies (how much they cover), the robustness (how ambitious and guided they are), and the alliance (the level of international coalition influencing them). The average score across all countries is 6.57 out of ten, just above half.

Europe leads with an average score of 7.93; European countries’ policies are bolstered by the fact that they receive regulatory pressure from two sources: their own country governments and the European Union agenda. European countries such as France (38 mandatory policies), Germany (38) and the Netherlands (36) have issued more policies, including EU measures, than all others in the G-20. France leads the pack with a total policy score of 8.32 out of ten, performing well on all three pillars of scope, robustness and alliance. However, all European countries perform relatively well, often standardized across the region due to EU directives and regulations that increase uniformity.

Major economies like the U.S. (4.85/10), China (5.71/10) and India (3.74/10) score poorly relative to their European counterparts. Not only have they not been quick to legislate net-zero targets, but they have not joined onto all the major coalitions that can increase global accountability and standardization. Non-European G-20 countries also tend to fall behind on the average ambition of their policies.

Lagging markets include Saudi Arabia (0/10), Turkey (1.69/10) and Russia (2.60/10), though they can still turn the tide. One hope is found in the fact that many old policies are regularly updated to incorporate new ESG considerations. Even lagging nations can look to these measures to speed up ambition quickly and learn from their peers. Coupled with the overall increase in policies globally, it’s possible these countries won’t always be bottom dwellers.

Disclosure policies help shape the ESG investment landscape

The performance of countries on these aforementioned policies is essential, as it lays the groundwork for more advanced regulations that focus on investors and financial practitioners, rather than just corporations.

ESG disclosure policies, which focus on collecting and reporting ESG data, are often the first step for countries. Some 383 of these policies have been created since 1997, more than any other policy type – with 87% geared at corporations. Disclosure policies have been losing dominance in recent years however: for the first time, policies pushing investors to integrate ESG into their strategies are surpassing those simply making corporations report on ESG. In order to be effective, these policies will require additional regulatory guidance on integrating sustainability considerations into everyday action, such as mandating the assessment of long-term ESG profiles of companies before pensions can invest in them.

All of these changes may fuel further growth in ESG investing, which has reached new heights in 2021. Through October, net inflows of investment in ESG exchange-traded funds totaled $96 billion, up from $76.7 billion through all of 2020. Growth like this may not be sustainable unless countries continue to play their part, creating robust policies that require investors and corporations to create an overarching ESG strategy, report on progress, and gear toward ambitious targets.