General Electric has announced it will launch a new, independent, industrial IoT company in 2019, in which it will place all GE Digital, GE Power Digital, and Predix products. This new business will provide software to GE, GE software customers, and new customers.

The rise of digital technologies and the Internet-of-Things provides industrial equipment manufacturers with a welcome opportunity to diversify. Companies like General Electric, Siemens and Toshiba have seen equipment sales fall for a couple of years, faced shareholder concerns over highly complex business offerings, and have been subject to rapidly changing customer demands. Sensors, connectivity, advanced analytics and artificial intelligence give this sector the chance to build new businesses or enhance their service offerings.

Many industrials have some form of data analytics they perform on their own assets during design, manufacture and deployment. But few are providing these analytics as a product to clients, and even fewer are trying to attract new clients with standalone data analytics and software products. Often their hardware clients want a separate, independent, software provider, with historic expertise in data analytics.

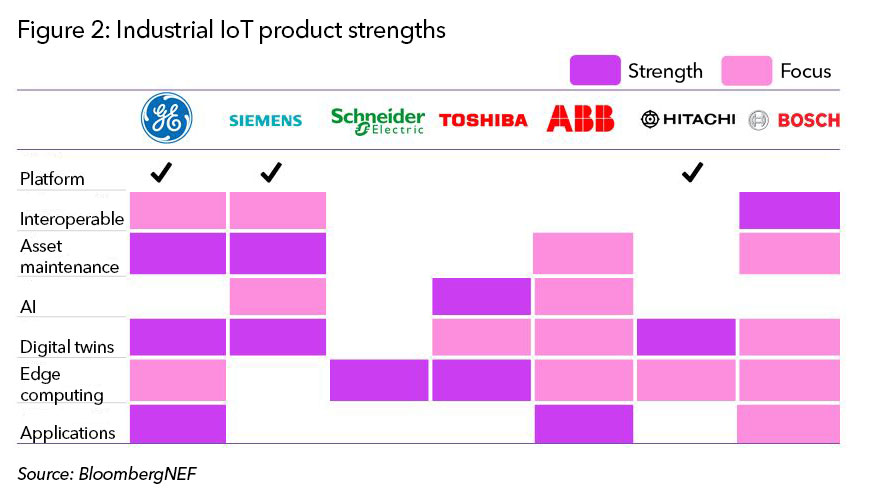

General Electric, Siemens, Schneider Electric, ABB, Hitachi, Toshiba and Bosch are some of the companies that, in different ways, are investing their money and their reputation in building some of the more advanced IoT platforms and asset analytics tools.

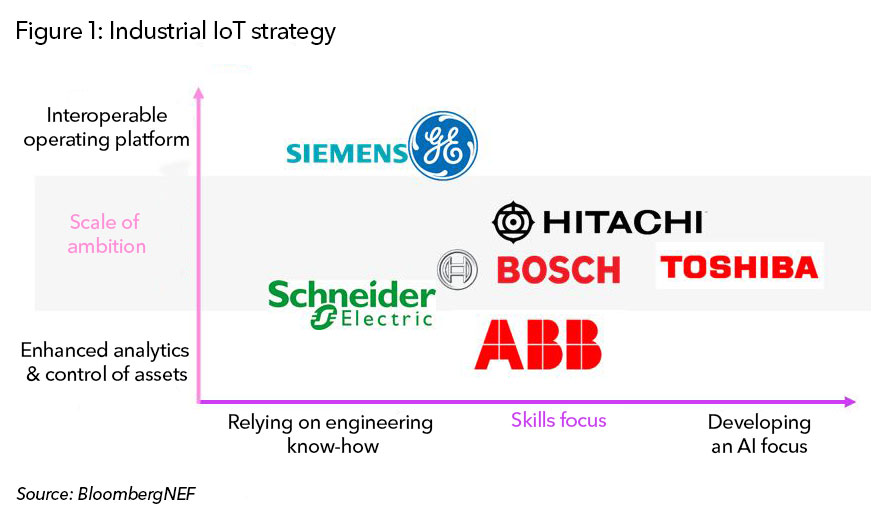

GE and Siemens aimed to build IoT platforms that span whole power fleets or oil company assets, integrating equipment of different types, brands and ages. ABB and Schneider are for now focusing on applying analytics just to their clients’ ABB or Schneider hardware. This means ABB is focusing on robotics and industrial manufacturing, while Schneider is becoming expert in grid digitalization. Toshiba is looking to leverage its knowledge of chips to build an IoT product based on machine learning, practicing on its own assets and buildings first. Hitachi is integrating a number of consulting and legacy software businesses to build one large IoT division, promoting Hitachi’s own server banks to host the software on client sites. Meanwhile, Bosch has formed partnerships to integrate its own applications with other tech and industrial companies, serving clients this way.

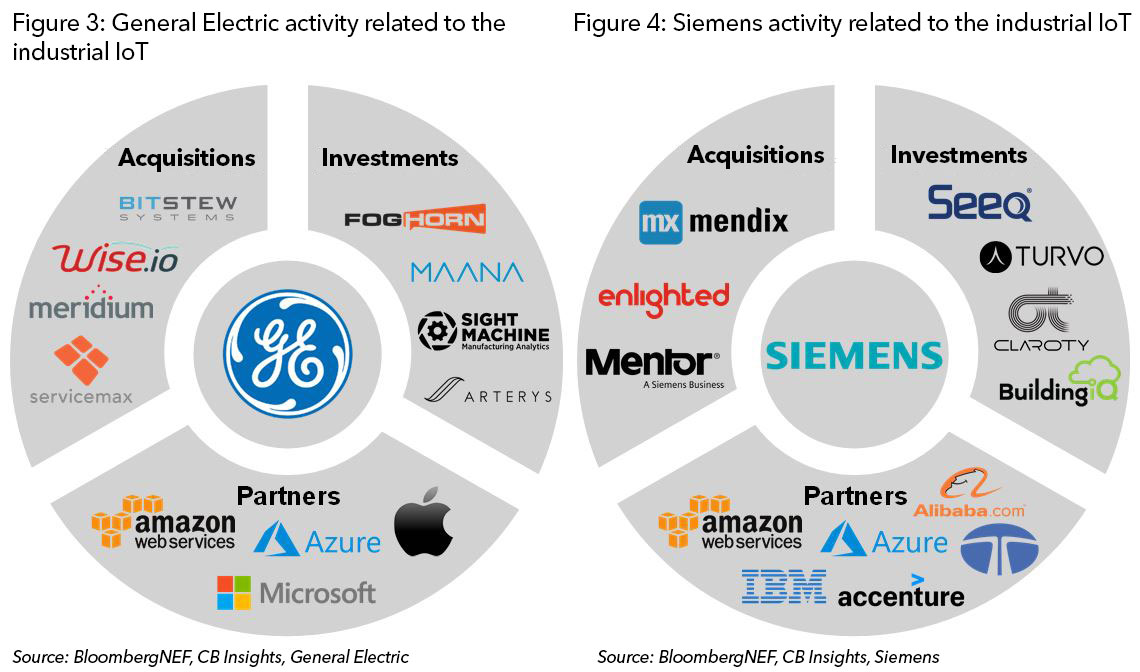

Where a few years ago industrials would have said that they were the right companies to build the entire industrial internet – back end, cloud infrastructure, and front-end apps – many admit now that this was ambitious. General Electric abandoned the idea of building its own cloud product in 2017, and now all the industrials mentioned here rely on Microsoft or Amazon Web Services for hosting their platforms and analytics in the cloud. Many have also turned to big tech to supply the infrastructure too, with the industrials counting on their own analytics applications to set them apart from each other.

These industrials have leaned heavily on acquisitions and strategic venturing to strengthen their software offerings. Although startups sometimes are a useful source of IP for industrials, they are also often a competitor, able to move more nimbly and develop better data models and machine learning tools.

Machine learning and digital twins are two technologies that have enhanced the software offering of industrial IoT platforms in recent years. However, industrials are still determining how best to market, deploy, and get customers comfortable with them. For instance, the technologies GE lists that will make up the new company remain historic software competencies of GE, which customers have been using for years. Namely: asset performance management (APM), data historian, automation (scada systems), manufacturing execution systems (MES), operations performance management (OMS) and all grid software solutions. It makes this new company look more like Aveva or SAP, than Microsoft or Google.

Two challenges that large industrials have in also selling software products like IoT platforms are the fact that the business model is so different from selling hardware, and sales cycles can take a long time and be expensive. Regarding business models, companies used to selling hardware have to pivot to modern software sales models, while keeping the payment structure simple for each client. This often means making industrial clients comfortable with ongoing ‘software-as-a-service’ payments. Second, with large industrials contract negotiation and installation can take a long time. By splitting out a smaller software company, GE may hope the new company will reduce its sales and product development costs, shorten sales negotiations, and become a more nimble company.

So although emerging technologies are a new opportunity for industrials, how much will digital software truly comprise of their future revenue? GE states this new company will be worth $1.2 billion. We have to assume this is the value they put on the IP in the technology portfolio plus the existing revenues from products like Predix. This $1.2 billion is not large enough to prop up the rest of GE’s business, but it does hope this software company will grow faster and more easily without being tied to the parent. Does this mean that other industrials will follow suit? In March 2018 Schneider Electric acquired 60% of the industrial software company Aveva, and then integrated Schneider’s asset management software into Aveva. This way, creating a stand-alone software company. Hitachi already has a slightly independent digital arm, in Vantara, created in late 2017. Yet other industrials, like Siemens are still striving to fully integrate IoT platforms into every department.

There are many challenges that large equipment manufacturers face in pivoting to software products, however, there is also a real chance for them to succeed. Large industrials must leverage their industry know-how, while also finding a way of attracting talent to help them build machine learning tools. Compared to big tech, industrials can build more effective products and business models because they understand the energy and manufacturing sectors better, and they are already trusted partners of utilities, oil, gas and manufacturing companies. However, industrials still have a long way to go – from developing truly interoperable software, to perfecting pricing strategy, to retraining the sales force.