By Julia Attwood

Head of Sustainable Materials

BloombergNEF

Net-zero emissions targets have thrown down the gauntlet to industrial emitters. The power and transport sectors have been investing hundreds of billions in deploying zero-emissions technology for the last decade. The heavy industrial sectors, like steel, cement, chemicals and aluminum have however been slower to invest, because it seemed like the technology and incentives were not there. That has now changed.

BloombergNEF recently published an in-depth report showing how the aluminum sector can decarbonize. It is the first in a series of reports that examine the technologies and costs of making industrial materials with near-zero emissions.

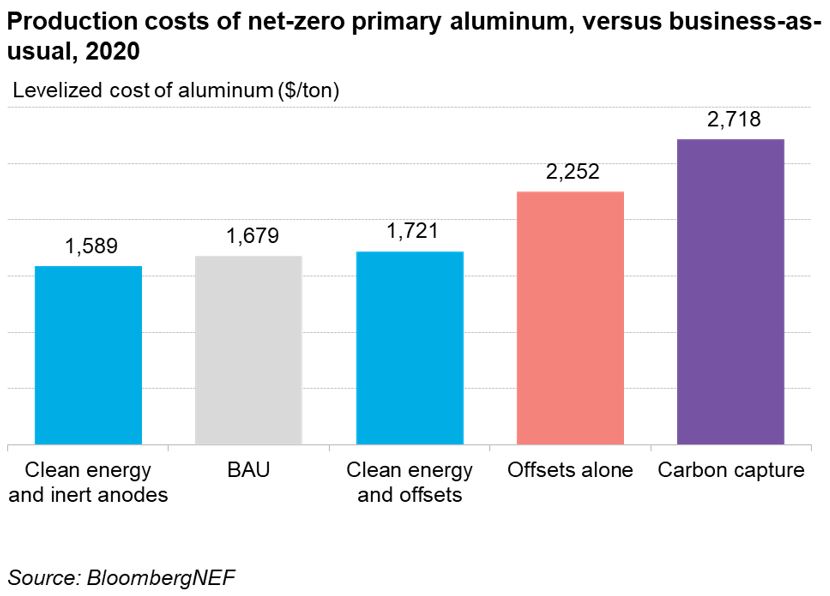

Net-zero primary aluminum is already competitive

Today, most aluminum is made from raw materials using a smelting process. Decarbonizing this primary aluminum smelting process requires two or more technologies – one to avoid or capture the direct emissions released when carbon anodes break down, and another to avoid or capture the emissions from electricity generation. Two low-cost options are available here: using inert anodes that do not release carbon emissions, and powering the smelter with clean energy. Using carbon offsets to ‘cancel out’ the anode emissions can be done for a similar cost, but carbon offsets vary dramatically in quality and are expected to be in short supply in future.

Low-cost decarbonization of aluminum is enabled by renewable energy, which is now cheap, and getting cheaper. For the moment, aluminum smelters can procure clean power through a ‘sleeved PPA’ (power purchase agreement), to virtually meet all their electricity needs. With this technique, the PPA ensures that enough clean power is generated to cover the smelter’s demand over the course of the year, even if on an instantaneous basis grid or fossil-fuel power is filling in the gaps when variable renewables are not generating. The cheapest PPAs can deliver power as low as $15/MWh today in places like the U.S., but when balancing is included costs come closer to $40-50/MWh. That makes it competitive with power from coal in most parts of the world.

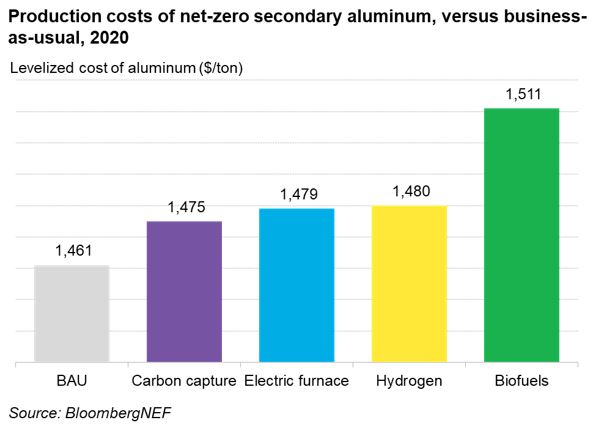

Green, recycled aluminum may cut into margins

Through recycling, aluminum can be produced with less than 5% of the carbon footprint of primary aluminum. While aluminum is already widely recycled, improving scrap metal collection and processing is the best first step to reducing the industry’s emissions. Decarbonizing aluminum recycling is technically straightforward. Scrap aluminum is heated in furnaces that typically run on natural gas to produce secondary metal. To eliminate the emissions, the furnace must run on a clean fuel, such as hydrogen, renewable electricity, or biofuels, or use carbon capture to capture with fossil fuels.

Unlike for primary material, there are no net-zero options that are cheaper than today’s fossil fueled business-as-usual process. However, where green resources are cheap, some can come close. Recycling margins may therefore shrink a little, but green production costs are still well below aluminum prices. And as the costs of clean energy, CCS and hydrogen fall in the future, net-zero technologies for secondary aluminum can close the gap. Hydrogen needs to reach a price of around $1.6/kg to compete with fossil fuels. BNEF expects many countries to be able to produce green hydrogen at this cost by 2030.

Policymakers and producers must move quickly

While it appears that there is a clear path to decarbonization for the aluminum industry, reaching net-zero by 2050 will require significant changes to the upstream alumina and downstream recycling supply chains. Policymakers can accelerate this shift by using carbon taxes to change the calculations. Most green technologies for primary production only require carbon prices between $5-35/ton CO2 to be viable, but to make new green recycling facilities competitive with existing fossil-fueled capacity would require taxes in the hundreds of dollars per ton of CO2. It would likely be easier for producers to charge a small green premium on recycled material, to make up for the increased production costs. But in a competitive, oversupplied market like aluminum, this requires buy-in from their customers, or a procurement mandate from the government.

While there are many technologies to make green aluminum, including retro-fit options, there is still a risk that carbon intensive assets become stranded. The cheapest solutions like inert anodes are not easy to retrofit, and hydrogen will take time to become widely available. To reach net-zero by 2050 all assets will need to have a transition plan. Some may have to increase their running costs dramatically by using carbon capture, or retire early and be replaced by clean capacity. To avoid this difficult choice, aluminum producers should accelerate their technology deployment, and make any new capacity they build ready to become net-zero.