The green bond market accelerated its momentum in 2021, with issuances doubling to $621 billion. By the end of last year, over $1.8 trillion of green bonds had been sold since the label made its debut back in 2007.

The proceeds of green bonds are used to finance or refinance eligible environmental activities. Europe is still the most prolific market and $308 billion of green bonds were issued in the region in 2021. Asia is growing the fastest, however, with its share of total issuances rising from 14% in 2020 to 24% in 2021.

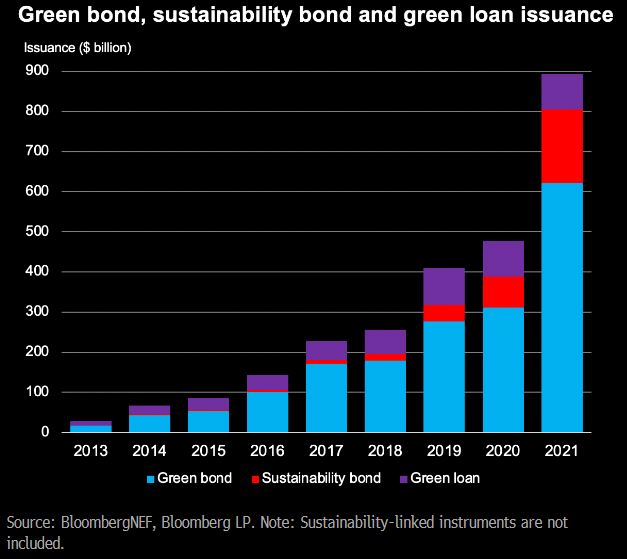

Green bonds are the most popular variety of sustainable debt, which more broadly describes borrowing linked to environmental or social purposes, such as renewable energy development or debt repayment tied to an institutional emissions reduction target. Issuances of bonds and loans to fund environmental and climate projects hit a record $894 billion in 2021.

Green loans, like green bonds, are raised to support environmentally beneficial activities. Green loan issuances came in just shy of $89 billion in 2021, and it was the only variety of sustainable debt to see a decrease in volumes in the past year, though only by a single percentage point. This may be partly due to a lack of disclosure in the private loan market, compared to the highly visible bond market.

Sustainability bonds are raised for environmental and social purposes, together. These totaled $184 billion in 2021, up 149% from 2020. Sustainability bonds are popular among development banks, which often undertake sustainable development projects in emerging markets.

For more detail on these findings, an abridged version of the 2022 Energy Transition Investment Trends Report can be downloaded from this page. BNEF subscribers can find the full report on the client website and on the Bloomberg Terminal.