This article first appeared on the BNEF mobile app and the Bloomberg Terminal.

- Green Bonds Toll has recorded $100.7 billion so far in 2018

- Uncertainty over whether $173 billion record will be broken

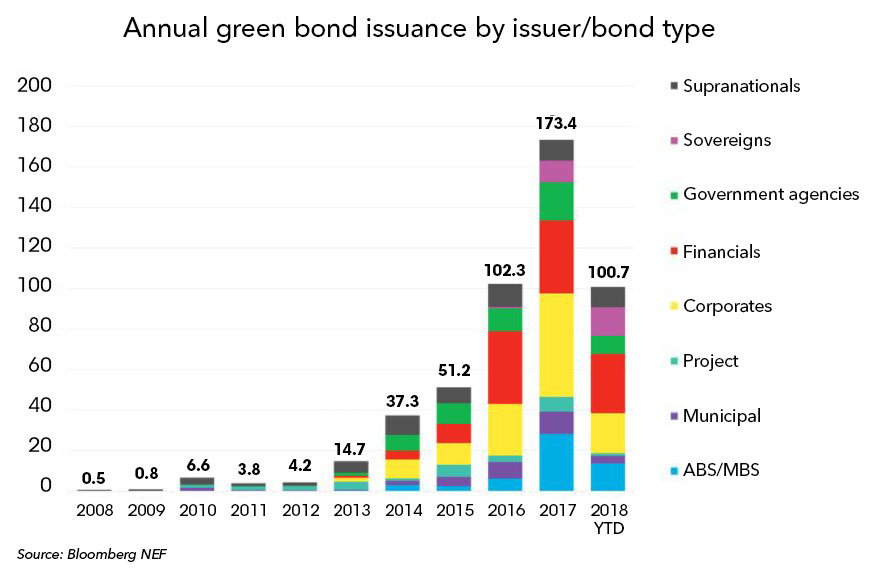

The Bloomberg NEF Green Bonds Tool has recorded total issuance of $100.7 billion so far in 2018. August was the quietest month in over two years, so issuance will have to increase significantly for last year’s $173 billion record to be broken. The Belgian government issued the largest green bond in 2018 at $5.5 billion, second only to the French government’s green OAT. Overall, the increase in European sovereign issues has helped the region gain a 42% market share this year.

Green bonds are fixed-income instruments, the proceeds of which are applied entirely for green activities that promote climate change mitigation, adaptation or other environmentally sustainable purposes. To obtain a green tag on the Bloomberg Terminal, the issuer or underwriter must demonstrate that 100% of all proceeds will be used for acceptable green activities.

BNEF clients can see the full “2H 2018 Corporate Energy Market Outlook” on the Terminal or on web.

BNEF Shorts are research excerpts available only on the BNEF mobile app and the Bloomberg Terminal, highlighting key findings from our reports. If you would like to learn more about our services, please contact us.