BloombergNEF report: Europe needs to mobilize over $32 trillion of investment to deliver a net-zero economy by 2050

New York and London, May 15, 2023 – Europe’s transition to a net-zero economy entails more than $32 trillion of investments in energy and related technologies between now and 2050, according to the New Energy Outlook: Europe report, published today by research company BloombergNEF (BNEF).

The report details a pathway for Europe (comprising the EU, UK, Norway and Switzerland) to reach net-zero emissions by 2050, selecting the lowest-cost technology solutions to decarbonize each sector of the economy – dubbed the Net Zero Scenario. It also includes a so-called Economic Transition Scenario, which only deploys the cheapest technologies without consideration for climate goals.

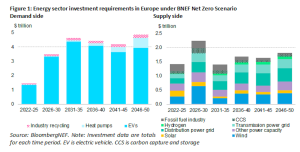

For Europe to achieve the Net Zero Scenario requires a step-change in investment into low-carbon technologies. According to BNEF, the region invested $227 billion in the low-carbon energy transition in 2022. To stay on track, average annual investments into clean energy supply, electric vehicles, heat pumps and sustainable materials in Europe need to run at more than three times this level for the rest of this decade, and more than four times in the 2030s.

Consumers key to drive net-zero transition

More than two thirds of the investment needed to deliver a net-zero energy economy in Europe sits on the demand side, meaning a successful transition will rely on consumers adopting clean technologies faster this decade. The biggest single slice of spending is on electric vehicles, which totals $21 trillion over 2022-2050 under BNEF’s Net Zero Scenario, while heat pumps see $1.4 trillion in investment.

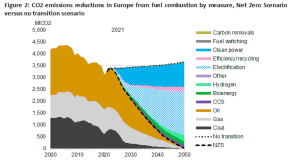

Road transport and heating for buildings are the two biggest challenges facing European policy makers to meet targets. Together these sectors contribute almost half of all energy-related CO2 emissions in Europe today. Both can rapidly displace their fossil fuel consumption and reduce emissions economically, largely through a switch to electric alternatives.

Europe must also plan for an expanded and digitalized grid that can integrate more renewables, electric vehicles and heat pumps. That requires unlocking investments in new grid infrastructure to the tune of $3.8 trillion by 2050 in BNEF’s Net Zero Scenario, and ensuring that flexible consumption patterns are encouraged.

“The next phase of the transition in Europe is going to rely on consumers choosing electric vehicles and heat pumps over fossil-fuel alternatives. This puts the focus on Europe’s automakers and heating industry to offer the right range of products.” said Emma Champion, head of Regional Energy Transitions at BNEF. Electrification of the end-use economy is the most important driver in decarbonizing the European economy, delivering 44% of cumulative emissions abatement over 2022-2050, in BNEF’s Net Zero Scenario.

Clean power can be the backbone of Europe’s transition

BNEF’s modelling finds that deploying wind and solar power at scale and investing in a fleet of clean back-up generating capacity is the cheapest way for Europe to reduce emissions and lower energy system costs, while diversifying away from imported fuels. A global energy crisis has already spurred European policy efforts to further diversify and decarbonize the energy system, and the region is already delivering on measures to accelerate the transition towards renewable energy.

Investment into new clean power assets in Europe totals more than $3.8 trillion by 2050 in BNEF’s Net Zero Scenario. This investment is heavily frontloaded, with almost 40% of it occurring before 2030. This means annual investment in clean power over the rest of this decade must be at twice the levels seen in 2022.

Solar and wind technologies alone supply 83% of generation by 2050, according to BNEF analysis. In the Net Zero Scenario, onshore and offshore wind capacity across Europe reaches 675 gigawatts by 2030, up from 234 gigawatt in 2022. Solar capacity meanwhile grows to 774 gigawatts by 2030, up from 226 gigawatts today. These variable generation sources will need to be supported by flexible back-up generation. In the medium term, BNEF analysis shows the cheapest mix to provide the necessary back-up hour-by-hour will come from batteries, gas plants with carbon capture and storage, and new nuclear plants. In the longer term there is a small but important role for gas plants fuelled with green hydrogen, as production costs for the energy carrier fall.

Europe is often seen as a leading region for climate and energy policy and has made the strongest progress globally in reducing energy-related emissions from their peak. Governments have a track record of setting targets and, in many cases, implementing concrete measures to deliver them. Yet pain points are emerging as the region moves to its next phase of decarbonization.

BNEF finds a disconnect between what is needed in terms of clean energy deployment, and real-world bottlenecks. The onshore wind sector in particular faces heavy challenges with permitting in several European markets that may limit the uptake needed, even if the technology is one of the cheapest options for decarbonizing power supply.

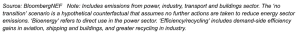

Europe needs deep decarbonization solutions

Clean power and electrification transform how final energy is used in Europe. By 2050, Europe needs 30% less energy for consumer end uses due to a phase-out of inefficient fossil-fuel processes in favour of electrification and other efficiency gains. Electricity rises from just 20% of final energy use today, to the single biggest contributor at 46% in 2050.

However, in addition to deploying clean power and electrification, the region also needs to invest in low-carbon fuels and clean industrial production capacity to decarbonize hard-to-abate sectors.

BNEF modeling shows that the least-cost approach could be using carbon capture as a bridge on the way to more deployment of green hydrogen. The Net Zero Scenario sees a quick ramp-up of carbon capture and storage capacity that peaks and stabilizes at around 150 million tons per year by the mid-2030s. Carbon capture and storage is used in the power sector to provide critical back-up as well as industries, such as cement and petrochemicals, where it can be cheaper and quicker to deploy than electrification.

Hydrogen emerges later, in applications where it is unfeasible or uneconomic to electrify. Production of low-carbon hydrogen rises from a low base to around 50 million metric tons by 2050 – around four times the total use of hydrogen today. BNEF research shows that the biggest new demand sources outside existing applications are zero-carbon steel production, dispatchable power generation, shipping and aviation. These sectors have more limited alternatives to fully decarbonize without hydrogen.

By 2050, Europe invests more than $904 billion into hydrogen and carbon capture and storage infrastructure to deliver on a net-zero energy system. Whether these deep decarbonization investments can be delivered and how much European industry can benefit will depend on the right set of policy designs and measures.

This research forms part of a series of regional and sector reports diving deeper into results from BloombergNEF’s global New Energy Outlook report. BloombergNEF will publish further regional reports for Australia, China, the US, Japan, and India over the coming months. Reports summaries are available at about.bnef.com/new-energy-outlook-series.

Contact

Oktavia Catsaros

BloombergNEF

+1-212-617-9209

ocatsaros@bloomberg.net

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration. For more information, visit Bloomberg.com/company or request a demo.