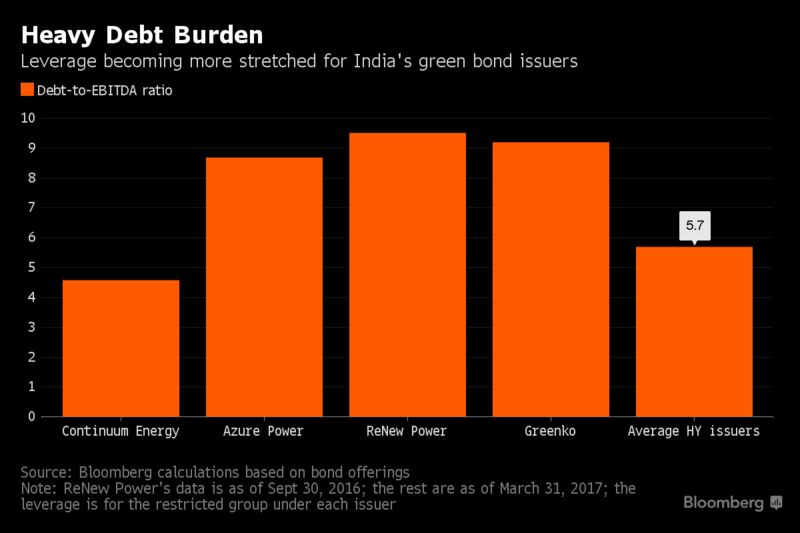

Debts at India’s renewable energy firms are on the rise, with most of them having leverage ratios that are higher than the average for high-yield bond issuers from the South Asian country. The weak credit quality of these companies poses a challenge for green projects, Moody’s Investors Service said last month. The stretched ratios come as more clean-energy companies such as Azure Power Energy Ltd. plan to sell dollar bonds, joining peer Greenko Energy Holdings, which raised $1 billion from note sales this month.