This article first appeared on the BNEF mobile app and the Bloomberg Terminal.

- State-owned NHPC auctioned 2 gigawatts solar capacity

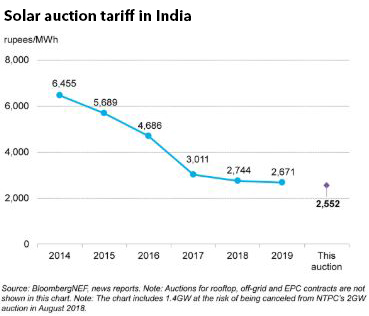

- Tariff bids were 4.7% below 2019 average

India auctioned 2 gigawatts (AC) of solar projects at tariffs below the 2019 average. At a time of great uncertainty caused by the Covid-19 lockdown, this reaffirms investors’ faith in the long-term prospects of solar in India.

The auction by the state-owned NHPC Ltd was reportedly oversubscribed and saw strong competition during the price bidding. The resulting tariffs suggest that developers have taken an optimistic view of the cost of financing these projects, even as a slowdown in India’s economic growth is expected.

The projects are expected to come online in 2022. This shields them from the supply constraints on equipment and labor currently caused by the lockdown.

According to news reports, the five winners at the auction were SB Energy (part of SoftBank), O2 Power (backed by private equity firm EQT and Singapore’s Temasek), Axis Energy, Avaada Energy and EDEN Renewables (joint venture of Total Eren and EDF Renewables). The presence of diverse foreign investors bodes well for the future growth of solar power in India.

Clients can find the full “India’s Solar Auctions: Bigger and Cheaper” on The Terminal or on web.

BNEF Shorts are research excerpts available only on the BNEF mobile app and the Bloomberg Terminal, highlighting key findings from our reports. If you would like to learn more about our services, please contact us.