This analysis is by Bloomberg New Energy Finance analyst Victoria Cuming. It appeared first on the Bloomberg Terminal and on BNEF.com.

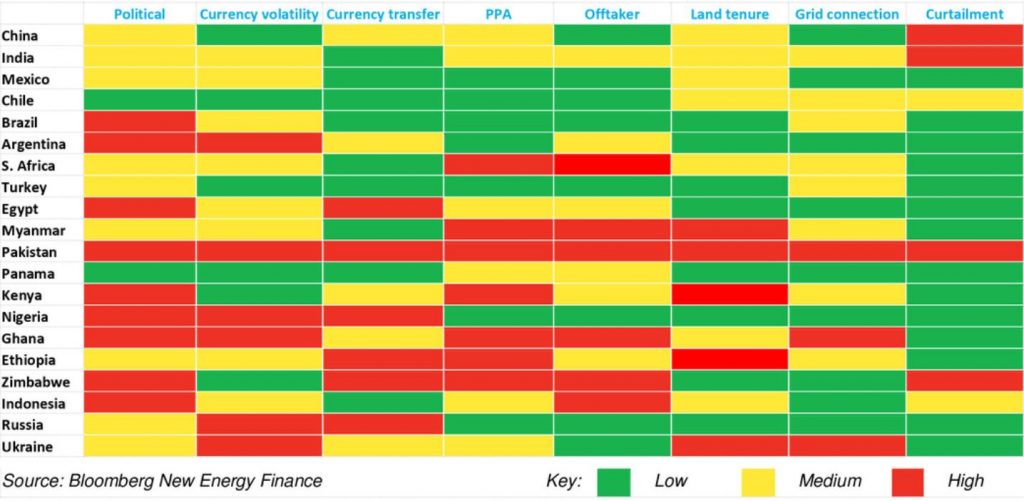

Every renewable energy project entails risk, but one in an emerging market can mean more, and different types of, risk including: political change, offtaker non-payment, power purchase agreement talks with no deal, currency fluctuation, interest rate rises, land-ownership rows and growing curtailment. There is no one-size-fits-all solution, although there are many instruments available on the market –for a price. And sometimes a tool is not necessary.

Risk matrix for a renewables project in selected emerging markets based on BNEF analysis

- Political risk insurance is more common in the power sector than a partial risk or credit guarantee, but the use of these tools has been limited for renewables. Reasons include high costs, complex application processes, preference for large projects, limited coverage, lack of awareness of the available tools, long processing times and stringent eligibility criteria.

- A sovereign guarantee might appear the Holy Grail for offtaker risk, but it is only as good as the government’s balance sheet, as found in Tanzania. A developer may secure a partial risk guarantee, though only debt lenders will be covered and only if the offtaker is state-owned.

- Companies vary in their use of currency hedging instruments: Enel prefers forward contracts and Canadian Solar also uses the more flexible but more expensive options. EDF keeps its foreign exchange positions open if no instruments are available, or if hedging costs are prohibitive, and instead monitors the risk on such positions using sensitivity calculations.

- Risk mitigation does not always mean purchasing an instrument of some kind: for example, a favorably negotiated power-purchase agreement (PPA) can help manage the risk of currency fluctuation, interest rate increases and curtailment.

- A geographically diversified portfolio of projects may reduce a developer’s political risk, while partnership with a local company and strategies to increase local buy-in may alleviate the risk of disputes over land ownership. Renewables developers vary in their geographic and technological diversification.

- Sometimes the risk mitigation is out of the hands of the developer: the government can help manage currency fluctuation for developers by paying tariffs in U.S. dollars (eg, Chile) or using a fixed exchange rate (eg, Ghana, Jordan).

This is an excerpt from a 27-page report available to Bloomberg and BNEF clients. Read more publicly-available findings from the report on the Climatescope 2017 portal.