Accelerated deployment of renewables within this decade combined with post-2030 deployments of nuclear and carbon capture and storage can enable Indonesia to achieve net-zero emissions by 2050

Bali, November 12, 2022 – The global net zero transition can represent a $3.5 trillion investment opportunity for Indonesia, according to a new report published today at the BNEF Summit Bali by research company BloombergNEF (BNEF) entitled Net-Zero Transition: Opportunities for Indonesia. Based on BNEF’s New Energy Outlook, its annual long-term scenario analysis on the future of the energy economy, the report examines how Indonesia’s energy supply may evolve under BNEF’s Economic Transition Scenario (ETS) as well as a Net Zero Scenario (NZS) compliant with the goals of the Paris Agreement.

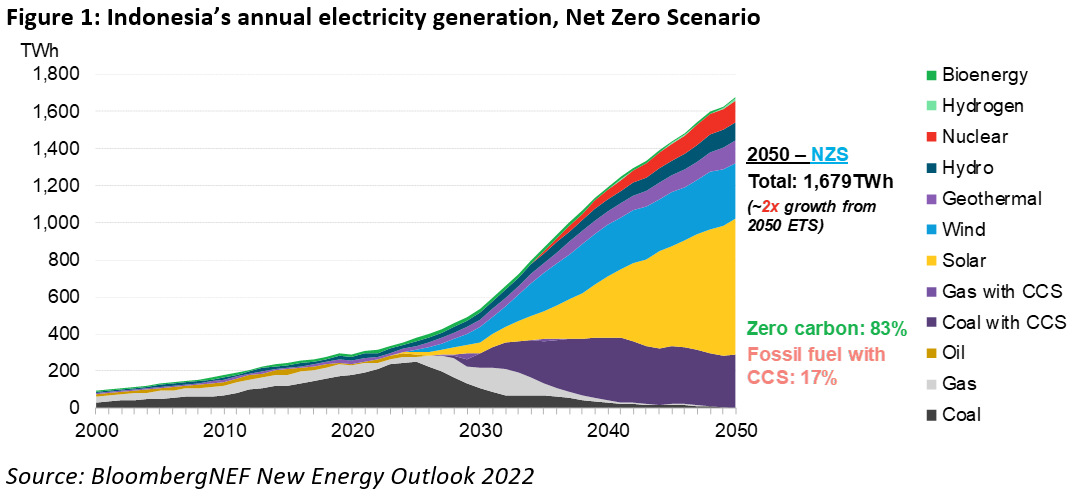

Both scenarios expect that growth in electricity demand can primarily be met by deployment of renewables such as solar, thanks to their falling costs. Under the ETS, Indonesia’s electricity demand is set to triple by 2050 to reach 919 terawatt-hours compared with 306 terawatt-hours in 2021. Today, coal-fired plants meet more than 60% of Indonesia’s power demand. Under the ETS, coal’s share rises to a peak of 74% by 2027 and then declines to 24% in 2050. By then, the combined share of renewables in electricity supply reaches 74%.

Under the NZS, Indonesia’s electricity demand is set to grow fivefold by 2050, as electricity accounts for a greater proportion of final energy demand, for example by replacing oil as road transport fuel. The NZS forecasts that 75% of electricity supply by mid-century would come from renewable energy, with the remainder supplied by coal power plants equipped with carbon capture and storage (17%) as well as supply from nuclear (7%).

Caroline Chua, BNEF’s Southeast Asia clean power lead analyst, said: “Under the Net Zero Scenario, as demand for Indonesia’s coal exports decline by more than 60%, domestic coal power plants equipped with carbon capture and storage could provide a just transition pathway for the country’s coal industry. On the other hand, Indonesia also needs to consider measures to accelerate the growth of renewables within this decade.”

The global net-zero transition also represents new export opportunities for Indonesia, as lithium-ion battery demand for electric vehicles is set to rise to more than 2 terawatt-hours annually by the latter half of this decade. Thanks to its wealth of nickel resources, Indonesia has already attracted plans for 25 gigawatt-hours of battery manufacturing capacity.

Allen Tom Abraham, BNEF’s Asia-Pacific lead transport analyst, said: “As the country with the world’s largest nickel reserves, Indonesia has significant opportunity to scale up lithium-ion battery manufacturing capacity. To do so, it will need to improve the environmental performance of its mining sector as well as increase domestic battery demand by accelerating the electrification of mobility.”

To finance the energy transition, Indonesia will need just under $2 trillion of investment in BNEF’s ETS and as much as $3.5 trillion under the NZS.

The full Net-Zero Transition: Opportunities for Indonesia report is available via the following link. BNEF’s complete annual New Energy Outlook 2022 will be published later in November 2022.

Contact

Veronika Henze

BloombergNEF

+1-646-324-1596

vhenze@bloomberg.net