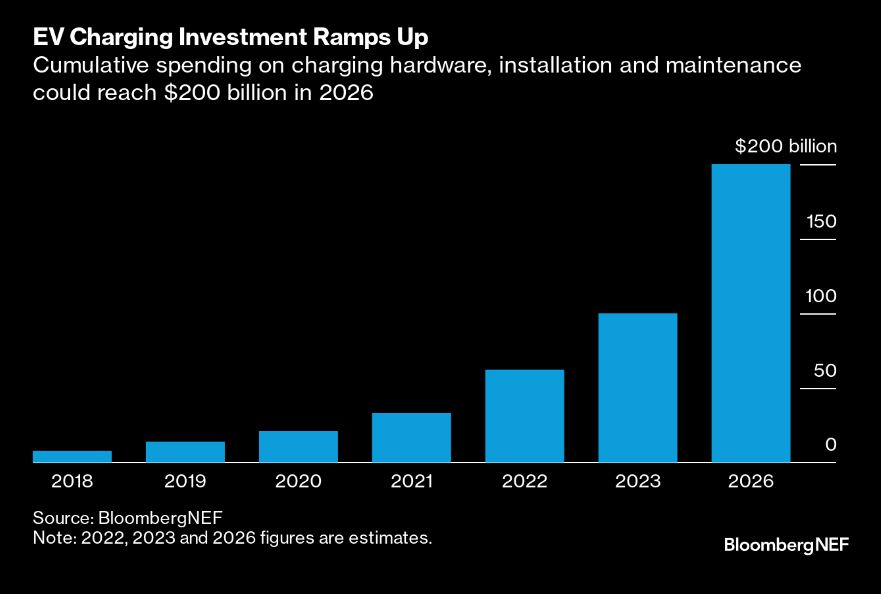

Total investment in electric vehicle chargers looks set to cross $100 billion later this year. It took about a decade to reach this level but the next $100 billion of spending will likely take only three years, according to BloombergNEF.

“We’re in a phase of high growth,” said Ryan Fisher, BNEF’s lead EV charging analyst. “Just look at the jump in numbers in 2022.”

Indeed, annual spending on EV charging infrastructure almost doubled to $62 billion last year.

The charging market is a reflection of the EV market, so China and Europe are in the lead. The US is gaining traction, however, with $7.5 billion of government funds having been set aside specifically for charging infrastructure under the bipartisan infrastructure law.

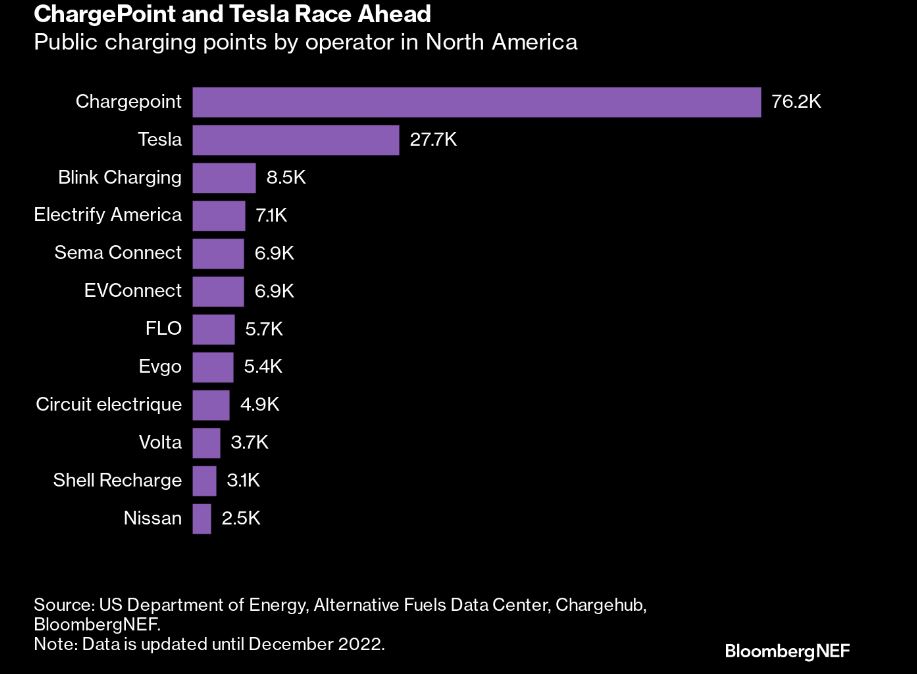

Mercedes-Benz announced plans for a network of 10,000 ultra-fast chargers last week and the automaker will start with the US. While Tesla currently dominates the EV market in the US, ChargePoint is in the lead when it comes to charging (although Tesla is the number one when only considering fast and ultra-fast chargers).

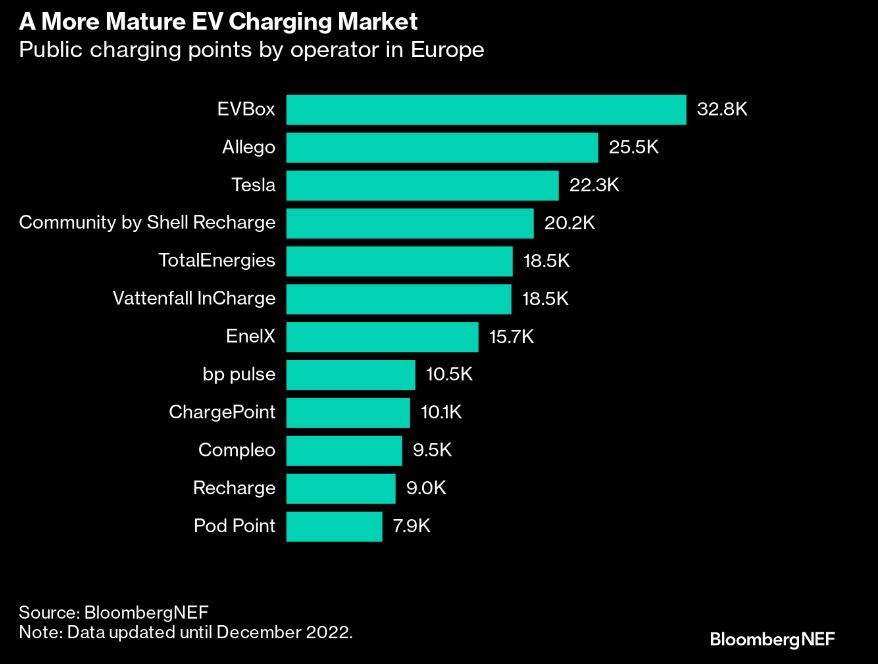

The European market is more balanced, with a much narrower gap between the top three EV charging operators than in the US. “The US market is picking up steam, while the European market is much more mature, with some consolidation potential,” said Fisher.

Automakers, oil companies, utilities, supermarkets and pureplay charging companies are all racing to build scale, and profit from a business that could one day be as ubiquitous as gas stations are right now. Shell aims to have 2.5 million EV chargers operational by 2030, many of which would be fast chargers that can add 100 kilometers worth of driving distance in just five minutes.

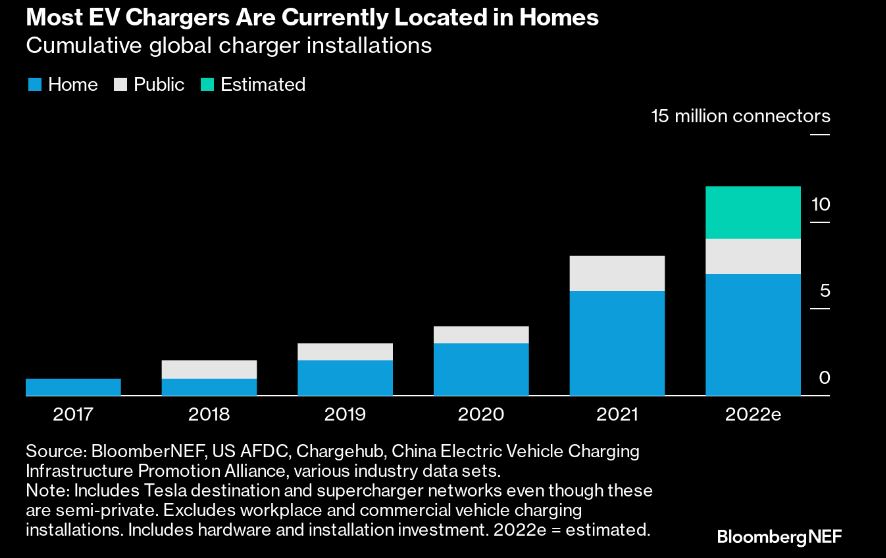

There are currently more than 12 million active EV plug points globally, with the number of home chargers exceeding public chargers. That will likely flip as the adoption of EVs increases.