The net-zero transition could upend certain industries and reshuffle the competitive standing of others. Specifically how this risk will affect company valuations is high on the minds of investors, particularly when it comes to high-emitting industries. BNEF’s Transition Scores product brings clarity to the impact of climate transition risk on company business models.

Revenue, market share at stake

Market conditions will shift under a net-zero scenario. Customer demands, asset valuations, and the cost of doing business among other things will all change. Transition risk is the degree to which these trends could disrupt business profitability and viability.

Some firms may suffer loss, for instance from the stranding of assets, while others could see growth, for instance from increased sales of low-carbon products. With net-zero a clear long-term systemic shift, financial forecasts and company valuations can only be accurate if they account for transition-related risk and reward exposure.

The extent of exposure is difficult to measure and to compare. Transition data is in high demand, but low supply. Especially when it comes to low-carbon activity there is a surplus of marketing but a surfeit of disclosure that allows for meaningful comparison. Moreover, identifying the right data and interpreting it correctly requires a thorough understanding of what the transition entails for each industry. BNEF addresses these hurdles by leveraging: its proprietary project-level low-carbon activity data – the product of analyst teams tracking emerging technologies, and its industry experts – whose mission is to understand what a changing future means for their sectors.

BNEF transition scores and how they work:

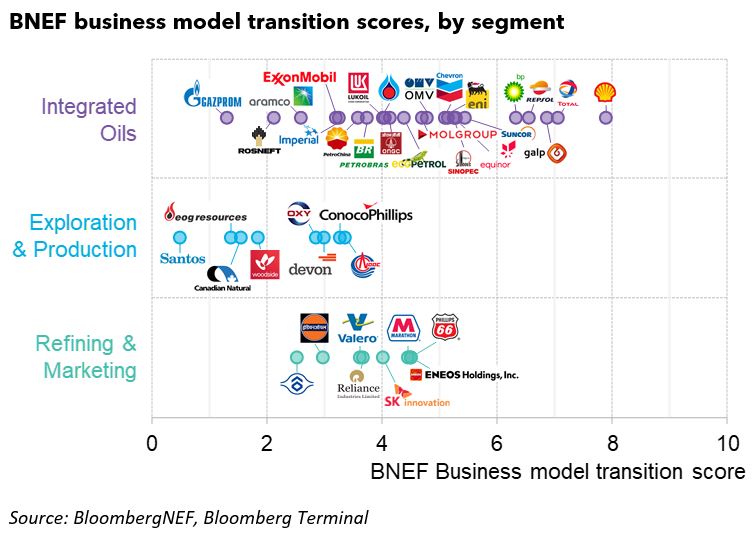

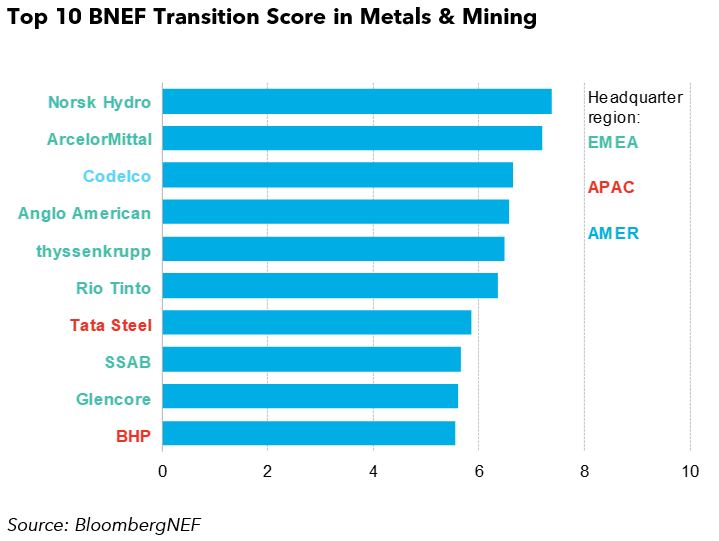

BNEF’s Business Model Transition Scores quantify transition risk and answer “how prepared is this company for a net-zero world, relative to its peers”. Calculations consider both upside potential from transition-related revenue expansion, as well as downside risk based on current business models. Scores are now available for 39 oil and gas companies as well as 53 metals and mining companies, with more industries to follow.

An industry-by-industry approach allows precise measurement of what transition entails for each sector, taking into account specific business models, emission profiles, and relevant datasets. The scores compare each target company’s transition progress and potential to a universe of peers, meaning scores are relative. A high score shows leadership within the peer group, and not that the company is universally well-poised for transition. All underlying data – down to the project level – and weightings are made available for download so that scores are understandable and open to scrutiny.

Oil and gas leaders

Integrated European majors, including Shell, Total, Galp, Repsol and BP are among the best-positioned in BNEF’s ranking. They are investing with depth and breadth in transition. To illustrate, they own 7GW, or 51%, of renewable energy assets among all scored companies. However, this is all relative as fossil fuel investments still dominate capital expenditures across the board. As a share of capex, Repsol, Galp and TotalEnergies lead the investment board, allocating over 20% of capex to low-carbon assets between 2015 and 1H 2021.

In general, integrated companies score higher than downstream players, who tend to beat exploration and production (E&P) firms. Downstream companies face fewer risks than upstream, as they have more flexibility to pivot into low-carbon business models such as refining biofuel, producing petrochemicals or even hydrogen.

Integrated companies perform best due to both lower risk exposure and better access to the skills and capital required to build a diverse range of low-carbon businesses, ranging from renewables to EV charging, biofuels and hydrogen. These companies are enormous and could lose most or all of their fossil fuel market. Both the scale of the risk and the scale of business necessitate a portfolio approach rather than betting on a single horse at this early stage in the development of most low-carbon markets.

Clients, more on the BNEF Oil and Gas Transition Scores: Leaders and Laggards here: web | Terminal.

Metals and mining leaders

Again, companies headquartered in Europe take the lead, boosted by a policy ecosystem and client base that prioritize climate transition. By material, aluminum and copper companies tend to perform best, as these metals are expected to grow in demand under a net-zero transition. In contrast, exposure to oil, gas or coal assets is linked to worse performance, particularly if no exit strategy has been announced. Miners and metals producers both fare well while integrated companies fall behind, in a notable departure from oil and gas industry findings.

Investments are ramping up across decarbonization technologies like electric furnaces, renewable energy, and metals recycling capacity. Hydrogen and CCUS draw a lot of attention, but projects are still rare and are strong differentiators in our analysis. In fact, only 16 out of 53 companies are active in these early-stage technologies at all.

Clients, more on the BNEF Metals & Mining Transition Scores: Results & Analysis here: web | Terminal.