Cheaper oil and progress combating operational bottlenecks will likely boost the fast-approaching US summer travel season, herding more travelers through airports and lifting demand for jet fuel. But clogged terminals and tight crude markets could still trigger headaches for carriers anticipating a less turbulent peak period.

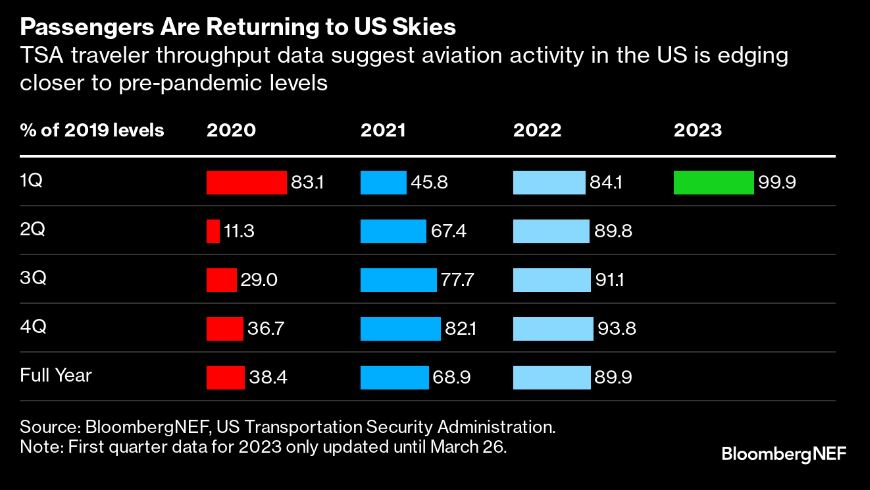

US air travel has muscled its way back, inching close to pre-pandemic levels. According to the US Transportation Security Administration, average daily throughput in the first quarter of 2023 was at par with the equivalent period of 2019. The annual number of travelers in 2021 was just 69% of a 2019 benchmark. But the figure rebounded last year, reaching 90%.

The US has arguably fared better than other key regions. Most countries in Europe had a tougher time emerging from virus lockdowns and travel restrictions. Average daily flights in the first quarter of 2023 in the Eurocontrol area were 86% of 2019 levels. Similarly, rebound in Asia remained muted in 2021 and 2022, as China, the globe’s second-largest jet fuel guzzler, imposed stringent Covid-Zero curbs.

More flights and jet fuel consumption this summer

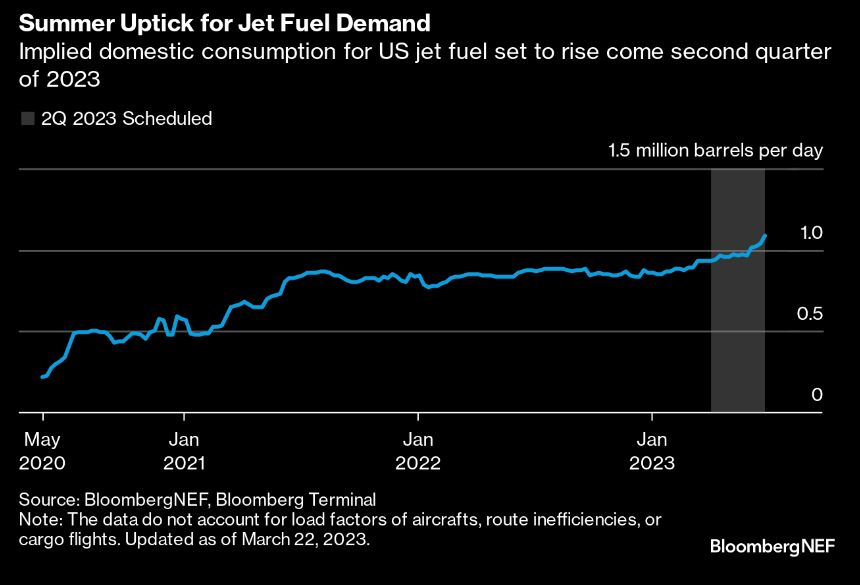

Flights in the US are scheduled to rise over the summer. Last year, labor shortages and supply chain bottlenecks at airports and airlines hindered a full recovery post-pandemic. However, huge efforts to recruit air industry staff and pilots over the past nine months will enable the anticipated climb in passenger demand this year.

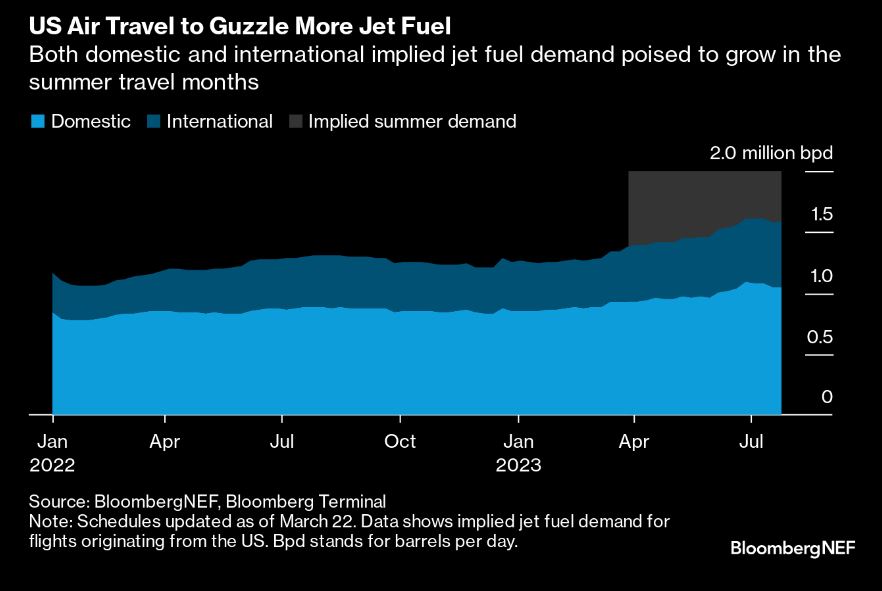

Based on DSET FLY data to March 22, the scheduled number of weekly US domestic flights is set to increase over 8.7% to more than 167,120 flights by early June. That implies an addition of over 75,000 barrels per day (b/d) in jet fuel demand.

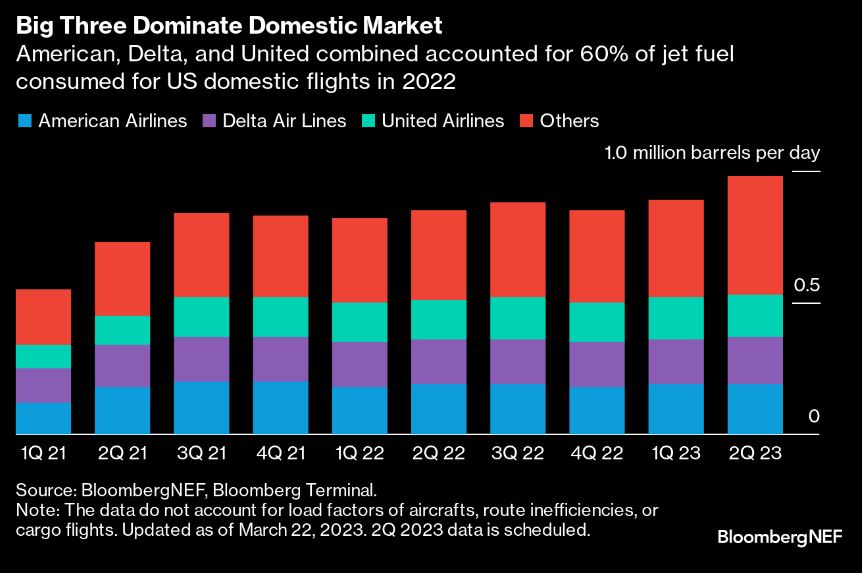

Collectively, the “Big Three” carriers – American, Delta, and United – dominate the domestic market, consuming 59% of jet fuel in the first quarter this year. Combined, they are scheduled to boost weekly domestic schedules by more than 2,715 (+3%) flights come June.

International flights from the US are also set to rise, with almost all countries worldwide now free of Covid restrictions. The weekly number of international flights scheduled to take off from American airports may grow 17.2% to June, implying an additional 0.11 million b/d in jet fuel demand from mid-March, according to DSET FLY data. International carriers including Air India, Air Serbia and Norse Atlantic Airways plan to boost flights to the US.

The rebound in longer cross-border flights, however, lags the recovery in the domestic market – explaining why current jet fuel consumption is below 2019 levels while traveler numbers are roughly in line. Incremental gains in aircraft efficiency also contributed to capping oil demand.

2022 price gains surrendered

US jet fuel prices have gradually eased over the past nine months, after rallying to a record high of more than $178 per barrel in mid-June 2022, when Russia’s invasion of Ukraine, refinery closures and pent-up demand tightened markets.

Bearish macroeconomic sentiments have put a lid on crude and product prices. The closest prices came to touching last year’s high was in late January, when they edged above $140 per barrel as bad weather led to US refinery outages.

Lower jet fuel prices have given airlines a respite following skyrocketing costs that dented last year’s recovery. Furthermore, the easing of refinery closures as well as capacity expansion, including Exxon’s 250,000 b/d Beaumont extension, brought some relief to markets.

With a bleak economic environment and expectations of more Fed interest-rate hikes, jet fuel prices entering the summer may be below 2022 levels. However, prices are above where they stood pre-pandemic, and as with any commodity unexpected events can trigger a change in market direction.

Zero fuel hedge strategy favored by ‘Big Three’

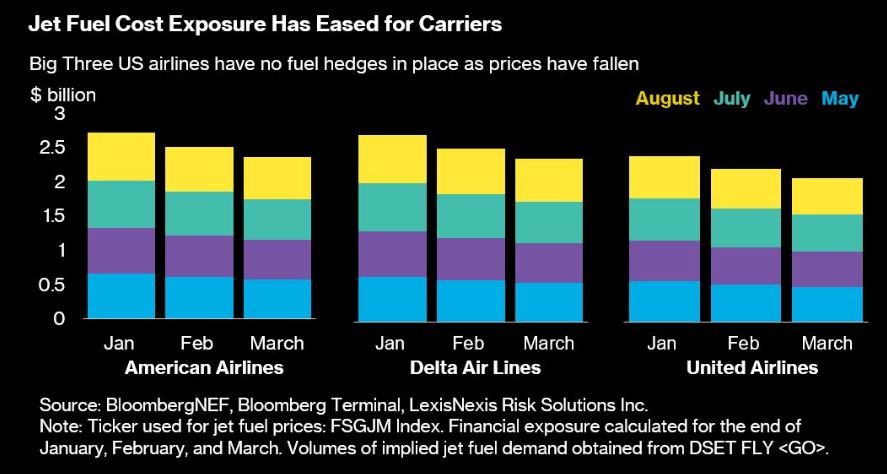

Companies can hedge risks from surging or gyrating fuel costs using derivatives such as swaps and options. But airlines’ exposure to jet fuel costs has dropped as prices eased.

American, Delta, and United are all known to have no jet fuel hedging in place, meaning they are more susceptible to any future fluctuation in prices. An escalation in jet fuel costs – the second-largest expense for carriers behind labor – can trickle down to push airfares higher, potentially deterring some travelers. Conversely, lower prices can benefit those who don’t hedge.

In the first quarter of 2023, jet fuel cost exposure for the period from May to August dropped by roughly 6.7% month-on-month for each of the Big Three, according to BNEF estimates. American Airlines, the largest consumer, saw exposure for the four specified months drop to $2.36 billion in March, from $2.71 billion in January.

Don’t sit back just yet

While carriers may see a less hectic and costly summer, risks remain.

A higher than anticipated surge in domestic and international travel demand may spawn logistical problemsfor both airports and airlines, an echo of last year’s supply-chain bottlenecks.

Technical glitches might also lead to mass cancellations and severe delays. In early January, nationwide outages of Federal Aviation Administration systems led to mass flight curtailments. Bad weather can’t be ruled out, either, with the US hurricane season typically occurring through the second and third quarters.

A steep rise in travel can structurally buoy oil prices. Any major supply-side shock, such as refinery outages, might cause prices to shoot up. One final supply factor to bear in mind is the inventory for US jet fuel, which has been sitting below pre-pandemic levels throughout the first quarter. Tightening global crude markets also loom.