Written by Aoyon Ashraf and Danielle Bochove. This article first appeared in Bloomberg News.

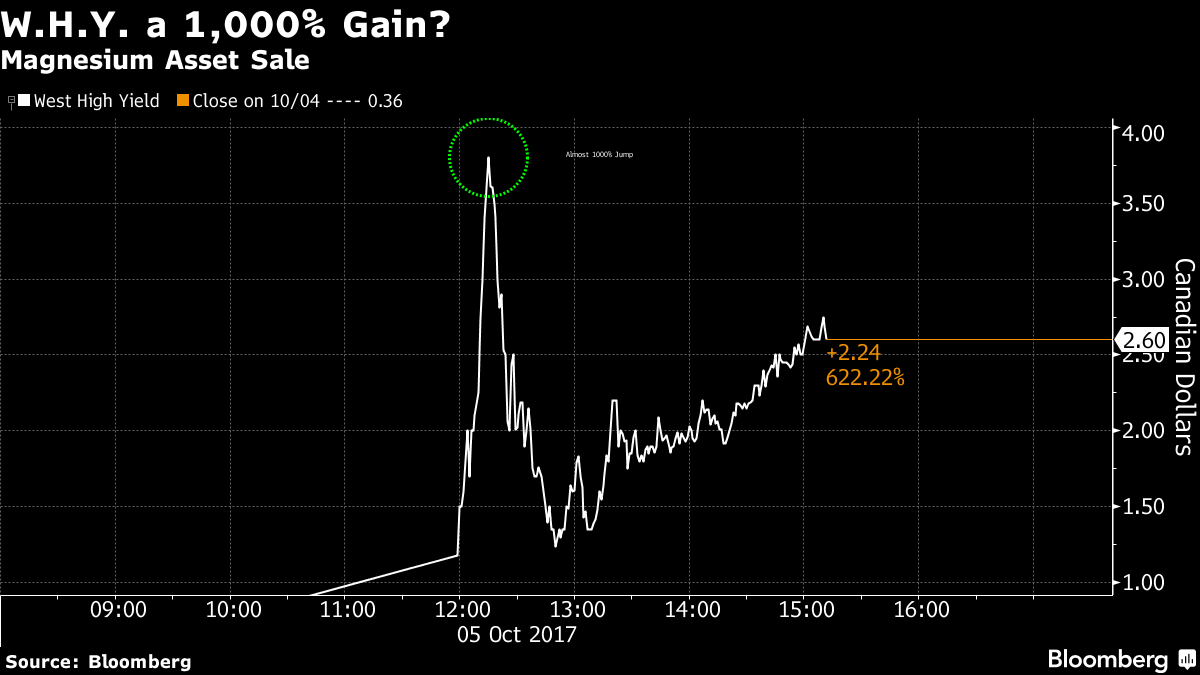

West High Yield (W.H.Y.) Resources Ltd., a little-known Canadian miner, surged as much as 1,000 percent after it said it sold a magnesium deposit to a U.S. buyer for $750 million — or 46 times the company’s market value.

West High Yield, which has no revenue, jumped five-fold in Toronto trading to close at C$2 after it released a statement saying it sold its main assets to Swanton, Maryland-based Gryphon Enterprises LLC. The shares, which trade under the ticker WHY, had closed Wednesday at 36 cents for a market value of just C$20.6 million ($16.4 million).

According to a West High Yield filing, the Toronto office of law firm Baker McKenzie represents Gryphon Enterprises. Greg McNab, global head of mining at Baker, was unaware of the transaction.

“I’m not aware that we act for them,” McNab, a partner at the firm, said by phone Thursday. “We’re not aware of any role in it.” Baker McKenzie employs 13,400 people in 77 offices, according to its website.

The Alberta Securities Commission, which regulates the Calgary-based company, said it’s “aware of the transaction,” but unable to comment further, according to Hilary McMeekin, a spokeswoman. Representatives for the Toronto Stock Exchange and the Investment Industry Regulatory Organization of Canada didn’t immediately return calls seeking comment.

Frank Marasco, chief executive officer of West High Yield, said he got the price he deserved for the asset on 7,891 acres near Trail, British Columbia, just north of the Washington state border. The deal shows the company’s shares have been “suppressed” for the past four years due to poor market conditions for junior miners, Marasco said Thursday in a phone interview. The stock has been listed on the Toronto bourse since 2006 and never traded above 98 cents until Thursday, when it soared as high as C$3.80.

“If you calculate the three sections of the land, there is about 3,000 years of supply” of magnesium that can be extracted from the property, Marasco said.

Stephen Cummins, CEO of Gryphon Enterprises, said via a Linkedin message that the sale is “absolutely a legitimate transaction.” He said the company will provide more information on the purchase “at the appropriate time.”

The financial backer of the deal wants to “stay anonymous at this point,” Marasco said.