The oil and gas sector faces energy transition pressures from regulators and investors and has made digitalization a core component of company strategy. Digital technologies present a way to reduce costs from existing operations and to create new revenue streams. They are also essential to monitoring, quantifying and reducing greenhouse gas emissions. BloombergNEF has created a Digital Innovation Score (web | terminal) to assess the progress of the world’s largest oil and gas majors and has published an analysis of the digital company strategy of the most advanced oil majors (web | terminal).

BP, Shell top the BNEF digital innovation scores

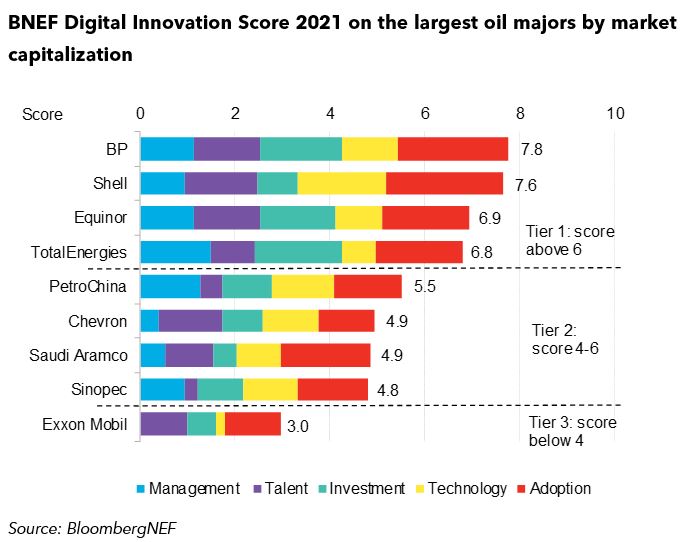

The Digital Innovation Score captures digital technology adoption levels and assesses how companies are positioning themselves for future innovation. The scores are comparative and rate the largest integrated oil companies on five metrics: management, talent, investment, technology and adoption.

European oil majors dominate the top tier of the rank, with BP, Shell, Equinor and TotalEnergies all scoring above six (out of a maximum 10). PetroChina is the highest-scoring Asia-based oil company while Chevron leads the U.S. companies in the rank.

The scores also highlight companies’ strength and weakness in digital innovation. For example, TotalEnergies has an ambitious digital strategy and has invested significant amounts, but there is less evidence that it has focused on developing in-house tech. In comparison, Shell is experienced in developing and adopting digital technologies, despite not being in the top rank for the management metric.

Company digital strategy is about choices

In BNEF’s digital strategy profiles, the analysis shows the clear choices that oil companies are making when investing in digitalization. Specifically, the scope of their ambition, the extent to which they want to make many strong technology partnerships, how they plan to benefit from their digital investments, and how they incubate technology and talent.

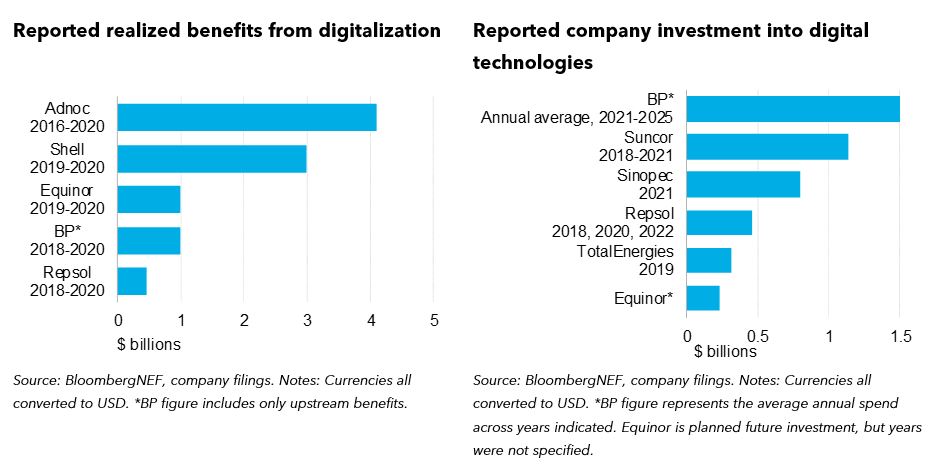

Digitalization is creating new business opportunities

Oil companies are beginning to announce the economic benefits from their digital investments, reflecting some impressive benefits. And after years of building their expertise to develop digital tools for internal benefits, oil companies are finding ways to sell their analytics capabilities externally. Some are selling technologies to peers in the oil sector. In its business accelerator, Launchpad, BP hopes to incubate companies that can each reach $1 billion in value by 2025. Launchpad currently has six companies in its portfolio. It aims to have 10-15 startups working on intelligence sensing and commodities in the portfolio by the end of 2022. Adnoc plans to sell oilfield planning software it co-developed with Schlumberger, and through AIQ, a joint venture with Group42, Adnoc can commercialize other digital products.

Other oil majors are targeting adjacent industries. In June 2021, Repsol announced the commercialization of Aria, its cloud-based data and analytics platform, to sell to industrial, commercial and management applications. Shell has launched data analytics tools for the mining and marine sectors, which complements its lubricant business.

Technology companies are capitalizing on oil sector digitalization

Technology partnerships are key to the oil sector’s digitalization. Oil majors have publicly announced 77 partnerships with cloud computing companies, oilfield services firms and technology providers since the beginning of 2020. BP, Repsol, Shell and TotalEnergies have all signed agreements with Microsoft and/or Amazon Web Services to co-develop data analytics and AI tools for decarbonization. Some companies are looking to use the tools for improving their operational efficiency, while others are hoping to help downstream customers decarbonize.